Electronic bank statements are the cornerstone of automated bank reporting. They enable CashAnalytics, as a specialised cash flow forecasting software provider, to offer live and consolidated cash balance reporting to our clients.

Although electronic bank statements can be obtained with a simple request to the issuing bank, banks typically don’t advertise this service, and therefore many companies may not be aware of electronic banks statements, or how they can be used to automate bank reporting processes and enable real-time visibility of cash flows.

Therefore, this article will offer an introduction what electronic bank statements are (taking examples of the two most commonly used formats: MT940 and BAI2), how they can be used, and aims to demystify the automation process.

It is our intention that, by the end of this article, you will have a broad understanding of how electronic bank statements enable real-time visibility of cash levels across the business.

For more detail at a practical level please read our whitepaper – Practical guide to bank connectivity: the key to live cash flow visibility.

Introduction to electronic bank statements

Electronic bank statements are a coded file type that can be easily read by other systems.

They contain transactional bank account data which can be electronically transferred from a bank to a company and, correspondingly, from a company to a bank.

While electronic bank statements come in a variety of formats, they typically all contain the same data components. These are:

- Account identifier

- Transaction type

- Transaction date

- Transaction amount

- Custom coding structures

- Reference data

- Opening balance

- Closing balance

The two most common electronic bank statement formats are the BAI2 (which is mostly used in the USA) and MT940 (which is used mostly in Europe).

The MT942 is also frequently used in Europe, and enables intra-day updating of information.

However, for the sake of clarity in this article, we will focus on the MT940 and BAI2 which both contain end-of-day data.

An overview of the BAI2 electronic bank statement format

As mentioned above, the BAI2 format is most widely used in the United States. It was developed by the Banking Administration Institute (BAI) and is used for cash balance and transaction reporting.

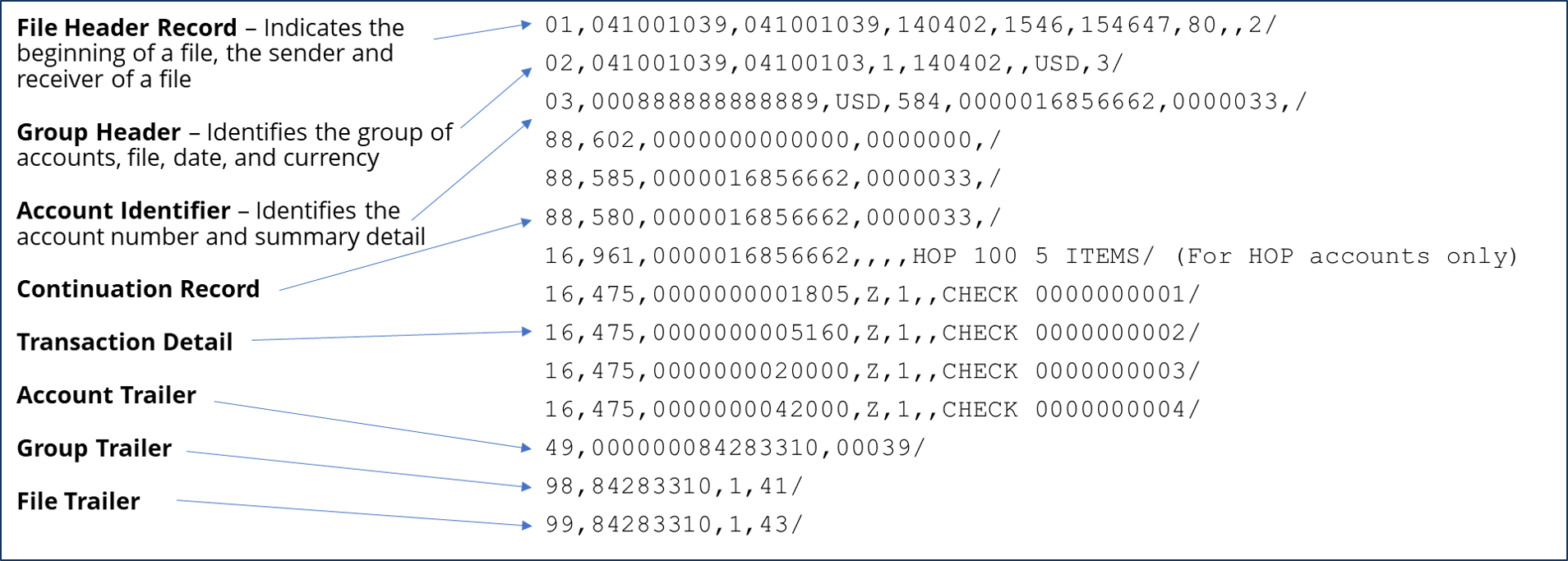

The diagram below shows what a BIA2 file looks like and explains the key coding components.

The individual transactions, and details relating to the transactions, are contained in the line(s) prefaced with 16. For a BAI2 file, each line prefaced with 16 represents a single transaction.

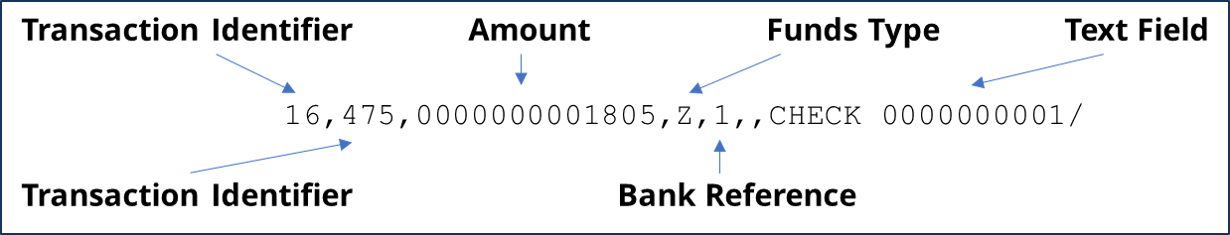

Below, we look at an individual transaction line and break down the key elements within a transaction for an example file.

From a reconciliation and classification perspective, the transaction and balance lines are most often of interest.

Breaking down the example above, we can see that it is a debit for $1,805 and has a text string of “CHECK 0000000001” which can be used for classification purposes.

The transaction identifier of 475 relates to the BAI2 classification code of “Check Paid”, by knowing this, it is quite straightforward to understand the data in the file.

An overview of the MT940 electronic bank statement format

The MT940 format was developed by SWIFT and is used for end of day bank account balance and transaction reporting. Structurally the MT940 format is quite similar to the BAI2 format.

MT940s are composed of a header block and a transaction block, with each block containing specific elements and pieces of information.

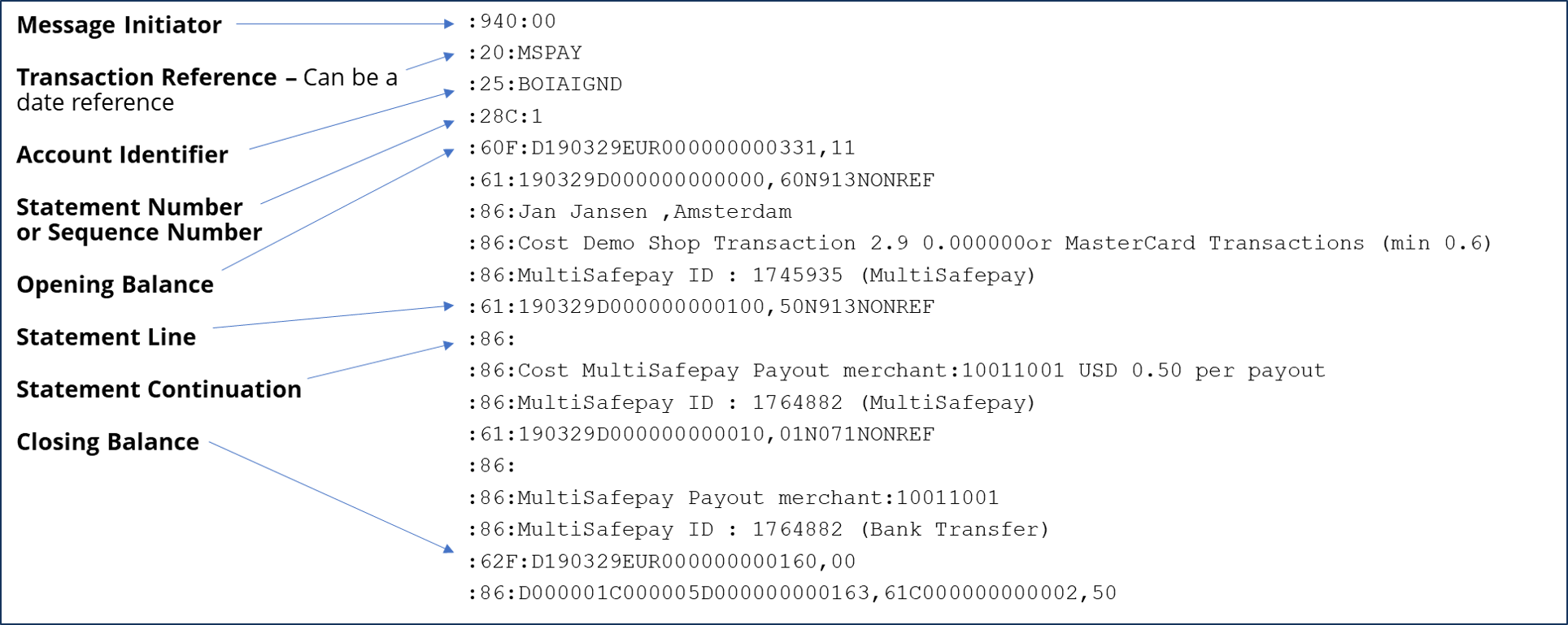

The diagram below highlights the key components in an MT940 file.

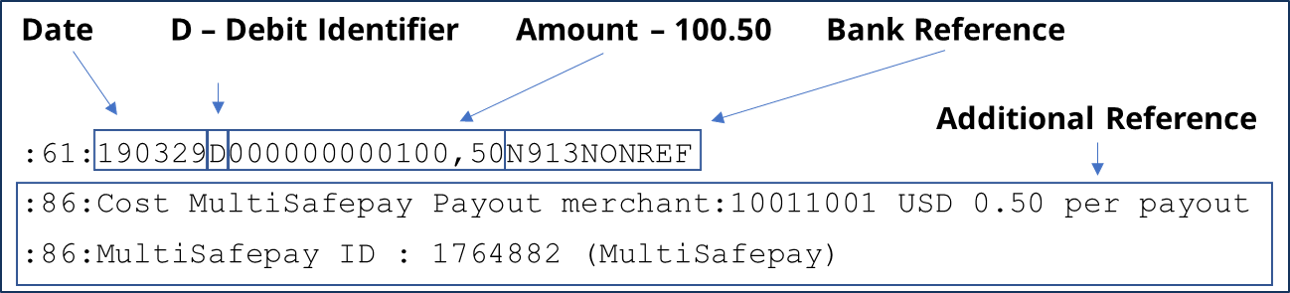

As shown above, each bank account transaction starts on a line that is prefaced with a :61 code.

Below we break down an individual transaction and look at the key components.

The above the statement line includes the line commencing with the :61 identifier but also includes the follow on :86 transaction lines (which contain additional information).

We can see that for the transaction above it is a Debit of 100.50, dated the 29th March 2019, and has a detailed transaction reference in line 86.

With most electronic bank statement file types (including both MT940 and BAI2 files) it is important to note that the specifications may vary slightly, and individual banks and financial institutions implement their own versions.

Therefore, while the core of the statement and message will adhere to the same broad principles there may be subtle differences from bank to bank.

How can these electronic bank statements be used?

Once you have an understanding of how these electronic bank statements work, you can begin to see how the data contained within them can be used to automate cash forecasting and bank reporting processes.

Though, as mentioned above, the exact format can vary between banks, the core consistency in the file types is fundamental to enabling automation.

Once small tweaks are made to adjust for the precise specifications from each bank, our automated cash forecasting and bank reporting software extracts the information contained within each file.

Additionally, once this information is loaded into the software platform, it becomes instantly reworkable.

When this is scaled up, it means that that the thousands (or millions, or tens of millions) of transactions a business makes each day can be reported on in real-time.

Therefore, when a client is in the set-up phase of automating their cash forecasting or bank reporting, rules can be built into the process that categorise certain types of transaction.

This means that reports can be generated at the touch of a button that consolidate balances by, say, business unit, product line, or geographical region.

By the same token, because all information is contained within the system, drill-down is possible right down to the most granular level of detail (each individual transaction).

What is bank reporting connectivity?

The name we give to the way that the process is automated, which also encompasses the methods of electronic file transfer, is bank reporting connectivity.

Now we have reviewed how bank reporting connectivity is, in part, enabled by electronic bank statements, to further understand how automation can save you time, enable push of a button reporting, and real-time visibility over cash flows, we invite you to read two of our whitepapers: Practical guide to bank connectivity: the key to live cash flow visibility, and our Cashflow Forecasting Setup Guide.

If you are interested in further reading still, by following this link you view the rest of our whitepapers and other resources, or alternatively you can view a full list of our blog articles here.

About CashAnalytics

As a dedicated cash flow forecasting software provider, CashAnalytics use a range of automation technologies and analytics tools to improve our clients’ cash forecasting and bank reporting processes.

If you have any questions about our software, or would like to see a demonstration where we can run through exactly how CashAnalytics can help treasury and finance teams add real value to their business, please contact us directly.