“CashAnalytics has enabled us to more easily compare our previous forecasts, increasing capabilities and driving enhanced accuracy, something that was very difficult to do in the previous Excel based model”

Shaun Curtis,

FP & A Manager, Kingfisher

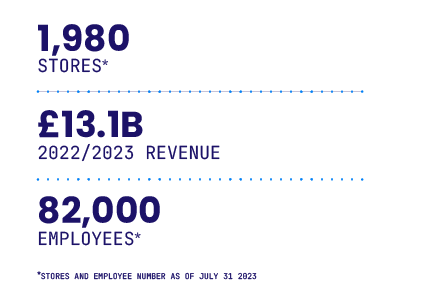

Kingfisher plc is an international home improvement company with 1,980 stores in eight countries. KIngfisher operates across Europe under retail banners including B&Q, Castorama, Brico Dépôt, Screwfix, TradePoint and Koçtaş. Kingfisher offers home improvement products and services to consumers and trade professionals via its stores and e-commerce channels.

Why does Kingfisher use CashAnalytics?

CashAnalytics is used to collect, consolidate and report on actual and forecast cash flow data from across the Kingfisher group to the Treasury and FP&A teams in head office. This data is used to support a range of activities, including:

1. Group-wide funding

CashAnalytics supports group wide funding activities in Kingfisher, ensuring business units have cash when they need and excess cash is put to the best use.

Commenting on the role CashAnalytics plays in the process, Shaun said, “It allows us to analyse the Group’s cash position and ensure that our cash position remains within our Group’s policies.”

2. Validating accuracy of indirect forecast

The Kingfisher FP&A team generate a long term cash flow using the indirect method, derived from their financial statements. CashAnalytics is used to validate the accuracy of the indirect forecast by ensuring that the sales and payments for each operating entity aligns with the direct method forecast generated by the system.

3. Management reporting and strategic planning

Consolidated forecasts are shared with senior leaders of the business; these support a range of short-term operational and strategic planning activities.

Key Features of CashAnalytics used by Kingfisher

Multi-business unit cash flow forecasting

Intercompany tracking

Multi-currency cash flow forecasting

Consolidation reporting

Cash sweep modelling

Variance and accuracy reporting

What type of forecasting process does Kingfisher run in CashAnalytics?

Every month 30 business unites from 19 groups across Kingfisher submit their forecast to head office through CashAnalytics. The frequency of the submission increases approaching half and full year end as the scrutiny of cash intensifies.

Kingfisher run a 13 week daily forecast in CashAnalytics covering key operating, financing and investing cash flow categories.

Alongside the analysis of consolidated per currency closing balance, sales and payment forecasts, the Treasury and FP&A teams carry out detailed variance analysis in CashAnalytics to quickly understand what’s changing from one forecast submission to the next.

Process overview

- 13 week cash flow forecast

- Submitted by 30 business units

- Monthly submission with (bi-weekly at half and full year ends)

- Key reporting outputs including forecast sales and closing balances per currency

- Monthly cash call with CFO, Finance Director, Head of Treasury and Head of FP&A

Key benefits of CashAnalytics

- Significant time saving at head office

- Detailed daily 13 week group wide cash visibility

- Fast and easy variance and accuracy analysis

- Improved indirect cash flow forecast accuracy