In today’s economic environment no one needs to be reminded of the importance of cash and efficient liquidity management planning. Corporate culture now focuses more intently on cash than ever before. Open the annual report of any large public organisation and cash related KPI’s are sure to be front and centre of business performance summaries. Large private companies are more likely to benchmark against cash flow targets as they aren’t constrained by market reporting requirements, which are typically accounting based. Private Equity, as another example, cares only about cash.

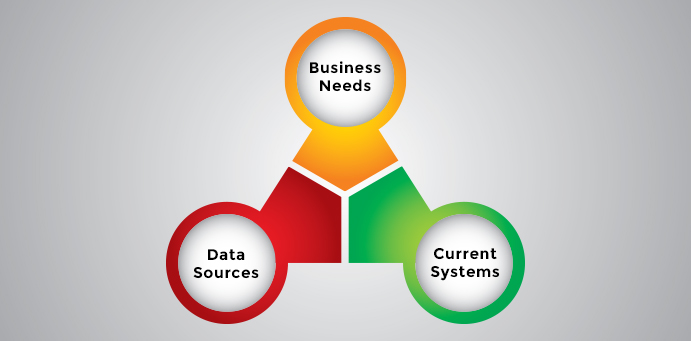

Central to efficient liquidity management is cash flow forecasting. A cash forecast is a tool used by finance and treasury professionals to get a view of upcoming cash requirements across their company. In this post we look at the key internal considerations when setting up a cash flow forecast. Broadly speaking they are influenced by three main drivers:

• Business liquidity needs;

• Sources of cash flow data; and

• Capabilities of current IT systems.

Business Liquidity Needs

In starting any process or implementing change, it is always advisable to start with the end in mind. For a cash forecasting process that means taking the time to analyse and understand the high level business objectives and consider how detailed the process needs to be. The bullet points below outline items to consider:

• Is the goal of forecasting to assist with short term, medium or long term planning?

• What reporting output do the CFO and CEO require? How frequently do they need a forecast position? Are any external stakeholders such as banks involved, what are their requirements?

• What level of FX breakdown and analysis is required? If the goal of the process is to assist with a hedging program it is critical that cash flows in entity operating currencies are captured.

• How many legal entities or subsidiaries should be involved in the process to gain the required level of visibility? Should the goal be to focus on the large entities that encompass 90% of the main cash flows or does the process need to capture all cash flows?

• What level of detail is required in the cash forecast, i.e. are only high level AP and AR classifications required?

• How regularly should the forecast be refreshed? How often does the executive team require an updated view of the cash position?

• Is working capital analysis important to the reporting process? If so, what additional non cash flow items need to feed into the process?

Data Sources

Following the identification of business needs, the next step is to figure out where the necessary data will be sourced. It may sound obvious but it is a crucial step on the way to designing an effective cash forecasting process. For example, if a business needs short term cash over, say, the next 10 business days, the majority of this information will be sourced from an ERP system or another platform that would manage AP and AR. Typically, ERP systems will contain 10 -15 days of reliable payment forecast data and provide some indication of expected receipts. Moving out the curve to a mid to long term forecast, it’s highly unlikely there will be reliable data in any system and it will therefore be necessary to interface directly with entity controllers.

Although the two examples above are the two extremes of the planning cycle, the key point is that the data required for a forecasting process can reside in many different locations. In terms of data sources, additional items to consider include:

• For each cash flow type (AP, AR, Tax etc.), where does the most up to date information reside? A good way to do this is to list each cash flow by type (forecast or actual) and map it to a data source, either a system or a department.

• If the data resides in an ERP system can this be extracted easily to contribute to the forecasting process? Does it make more sense to access the data from a Data Warehouse?

• For data residing in systems who is the key internal resource that will assist with each system?

• What do entity controllers use to manage their own forecast? Can this be easily integrated with a central model?

We have written more about this here.

Capabilities of Current Systems

When analysing where data is sourced, this invariably involves reviewing the current finance systems already in place. Therefore it is a natural follow on to consider the functionality of these systems. In terms of assessing the current systems in place, it is prudent to assess if they are “fit for purpose”. Important factors to consider are:

• Does any in-house technology address the requirements outlined above?

• If so what would be the cost and timeframe of adapting/modifying existing systems to manage the process

• How old is the current technology and is it up to current security standards?

• If the current system is a back office finance system does this provide adequate ease of use for entity controllers?

• If we build or “bolt-on” to an existing system how will this affect the upgrade path of the existing software?

• Would the proposed solution deliver the flexibility to meet the challenges that occur with changing business requirements and external conditions?

• How do existing software packages stack up in comparison to best in class forecasting systems?

Understanding the business drivers when initiating a cash forecasting project is critical to ensuring not just a successful implementation but also building a sustainable process. Internal considerations are the place to start, from the needs analysis, to where the information resides, through to tools that can be used to help manage the process.