Cash flow forecasting is the process of estimating the flow of cash in and out of a business over a specific period of time. An accurate cash flow forecast helps companies predict future cash positions, avoid crippling cash shortages, and earn returns on any cash surpluses they may have in the most efficient manner possible.

Forecasting cash flow is typically the responsibility of a business’s finance team. But the process of building a forecast requires input from multiple stakeholders and data sources within a company, especially in larger companies.

Here’s how to build a cash flow forecast that gives your organization the visibility it needs to utilize its cash effectively.

How to Forecast Cash Flow

The best way to forecast cash flow for your business depends on your business objectives, your management team’s or investor’s requirements, and the availability of information within your organization.

For example, a company seeking to gain visibility over quarter-end covenant positions will need a different forecasting process than a company that needs to manage debt repayments on a weekly basis. Here’s the process we recommend for building a cash forecasting model, as well as what kinds of data you’ll need access to in order to do so.

Note: For large/multinational organizations, building a cash flow forecast is a very involved process. If you’re building a forecasting process for that kind of business, our Cashflow Forecasting Setup Guide goes into the process below in greater depth.

1. Determine Your Forecasting Objective(s)

To ensure you see actionable business insights from a cash flow forecast, you should start with determining the business objective that the forecast should support. We find that organizations most commonly use cash forecasts for one of the following objectives.

- Short-term liquidity planning: Managing the amount of cash available on a day-to-day basis to ensure your business can meet its short-term obligations.

- Interest and debt reduction: Ensuring the business has enough cash on hand to make payments on any loans or debt they’ve taken on.

- Covenant and key date visibility: Projecting your cash levels for key reporting dates such as year, quarter, or month-end.

- Liquidity risk management: Creating visibility into potential liquidity issues that could arise in the future so you have more time to address them.

- Growth planning: Ensuring the business has enough working capital on hand to fund activities that will help grow revenues in the future.

The right objective to build a forecast to support depends on the nature of your business. For example, businesses with debt will find value in creating a cash forecast that helps them prepare for payments they need to make. But they may not have a need to build a forecast that supports short-term liquidity planning unless they’re also tight on cash.

2. Choose Your Forecasting Period

Once you’ve determined the business objective you hope to support with a cash flow forecast, the next thing to consider is how far into the future your forecast will look.

Generally, there’s a trade-off between the availability of information and forecast duration. That means the further into the future the forecast looks, the less detailed or accurate it’s likely to be. So, choosing the right reporting period can have a big impact on the accuracy and reliability of your forecast.

Here are the forecasting periods we recommend and the business objectives they’re best suited for:

- Short-period forecasts: Short-term forecasts typically look two to four weeks into the future and contain a daily breakdown of cash payments and receipts. As you might expect, short-term forecasts are often best suited for short-term liquidity planning, where day-to-day granularity is important to ensure a business can meet its financial obligations.

- Medium-period forecasts: Medium-term forecasts typically look two to six months into the future and are extremely useful for interest and debt reduction, liquidity risk management, and key date visibility. The most common medium-term forecast is the rolling 13-week cash flow forecast.

- Long-period forecasts: Longer-term forecasts typically look 6–12 months into the future and are often the starting point for annual budgeting processes. They’re also an important tool for assessing the cash required for long-term growth strategies and capital projects.

- Mixed-period forecasts: Mixed-period forecasts use a mix of the three periods above and are commonly used for liquidity risk management. For example, a mixed period forecast may provide weekly forecasts for the first three months and then on a month-to-month basis for the next six months after that.

3. Choose a Forecasting Method

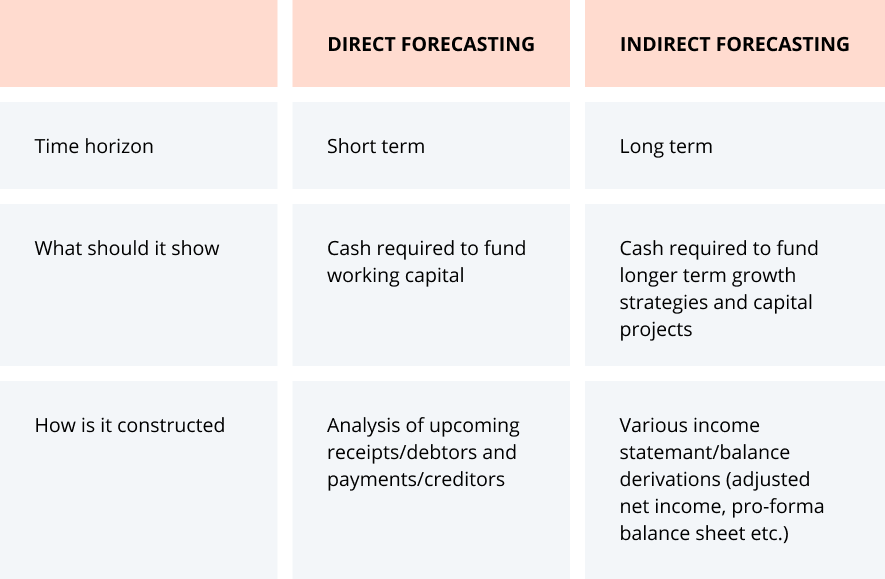

There are two primary types of forecasting methods: direct and indirect. The main difference between them is that direct forecasting uses actual flow data, where indirect forecasting relies on projected balance sheets and income statements.

Choosing the right forecasting method depends on the cash flow forecasting window you selected above, as well as the kind of data you have available to build your forecasting model. Here’s a breakdown of what each method is most effective for:

Generally speaking, direct forecasting provides you with the greatest accuracy. However, it’s often unreliable for reporting periods longer than 90 days because actual cash flow data isn’t always available beyond that window.

4. Source the Data You Need for Your Cash Flow Forecast

Direct forecasting provides the greatest accuracy and works for the majority of business objectives that companies build forecasts to support. Therefore, we’ll focus on where to find actual cash flow data for your forecast in this section.

The right place(s) to source cash flow data for your forecast ultimately depends on how your business manages its finances. But, generally speaking, most of the actual cash flow data you’ll need to build your forecast can be found in bank accounts, accounts payable, accounts receivable, or the accounting software you use.

Here’s what you’ll want to pull from those systems:

- Your opening cash balance for the forecasting period: This is normally taken from the most up-to-date and accurate reflection of current positions.

- Your cash inflows for the forecasting period: Anticipated sales receipts from within the forecasting period are usually the primary source of data for your cash inflows. Other types of cash inflows to consider including are intercompany funding, dividend income, proceeds of divestments, and inflows from third parties.

- Your cash outflows for the forecasting period: We recommend capturing wages and salaries, rent, investments, bank charges, and debt payments. But you can include anything that’s relevant to your business.

A Cash Flow Forecast Example (Medium Term/13 Weeks)

A 13-week cash flow forecast is the most common forecast because it provides the best balance of accuracy and future-facing visibility. Here’s an example of what a rolling 13-week cash flow forecast actually looks like from CashAnalytic’s forecasting platform:

Note: The data breakdowns in the far left column can be structured any way you find most useful for your organization.

While the template above is just an example of one type of forecast, it’s a good starting point for how to structure any cash forecasting model you build, whether in a spreadsheet tool or in an automation platform like CashAnalytics.

The Advantages of Cash Flow Forecasting

In addition to ensuring that a business avoids cash shortages and earns a return on any cash surpluses, cash flow forecasting helps businesses thrive in other ways, such as:

- Helping businesses get out of debt faster: Debt repayments are often large cash outflows that need to be planned for. Cash flow forecasting can help businesses that are in debt ensure they have the cash on hand to make those payments (and any interest payments associated with that debt) each time they’re due.

- Ensuring businesses adhere to debt covenants they may be accountable for: Debt covenants are financial restrictions that are placed on a business by the lender. For example, some lenders require a business to maintain certain cash levels in order to ensure it’s financially healthy enough to make payments on what it owes on a regular basis. A cash flow forecast can help businesses identify potential cash flow issues that might result in a covenant breach, which could require them to pay the balance of their loan in full, on-demand.

- Enabling businesses to grow more predictably: If a business is growing through investment, it’s usually burning cash flow to do so. Since cash flow forecasts help businesses plan their cash surpluses more effectively, they also make it easier to execute a growth strategy in a more predictable way.

How Automation Can Streamline Cash Flow Forecasting

Large companies often invest a lot of time and energy into forecasting at both a corporate and business level. But the majority of that time is spent on low-value activities like data collection and manipulation in spreadsheets rather than high-value activities like drawing useful insights from their data.

No finance or treasury function could run without spreadsheets. But automating the entire cash flow management process can save upward of 90% of the manual effort required to build and analyze a forecast using a spreadsheet.

Automation can also help an organization scale its forecasting process as it grows and changes as well. For example, when European brands Brammer and IPH merged to become RUBIX, they used CashAnalytics’ cash forecasting automation to simplify the work required to monitor cash levels and needs across their organizations as they merged.

To learn more about automating your cash flow forecasting process with CashAnalytics

Book a demo with one of our experts here