A cash forecasting model is the reporting structure and logic that produces a Cash Flow Forecast. Cash forecasting models are typically built using two dimensions: a business’s cash flow and a specified reporting timeframe.

A well-designed forecasting model helps businesses plan for future cash shortages and surpluses more efficiently. However, a well-designed forecasting model will look different for every organization since the best way to design the model depends on an organization’s unique business objectives.

Below is the process we recommend for designing a cash forecasting model that will provide your organization with the visibility it needs to make effective business decisions with its cash.

1. Determine Your Business Objective

The more you tailor your forecasting model to a specific business objective, the more likely it is that your model will provide useful insights. So the first step in building an effective model is to hone in on the objective you want it to support.

We find that organizations most commonly use cash forecasts for one of the following objectives:

- Short-term liquidity planning: Monitoring your business’s cash balance on a day-to-day basis to meet short-term obligations like salaries or vendor payments

- Interest and debt reduction: Planning for payments on any loans or debt your organization has taken on

- Covenant and key date visibility: Forecasting cash levels on key reporting dates, such as a month, quarter, or year-end

- Liquidity risk management: Identifying liquidity shortages that might arise, so you can plan to address them

- Growth planning: Managing working capital to fund activities that will help grow the business

It’s worth noting that there is often overlap between a forecasting model that best supports one objective and a model that best supports another. For example, businesses that wish to design a model to support liquidity risk management could also find that model useful for interest and debt reduction.

The extent to which there is an overlap will depend on the next two steps.

2. Choose a Reporting Period

Your reporting period refers to the granularity with which you project cash levels. The most common reporting periods are daily, weekly, and monthly. The best reporting period to choose for your forecasting model will depend on the business objective you selected above and how far into the future you wish to forecast cash flow.

Here are three of the most common reporting periods and the business objectives they’re best suited to support.

Daily Reporting

Daily reporting classifies cash flow data on a daily basis. Daily Cash Forecasting is particularly useful for short-term liquidity management, where companies require a detailed view of cash positions and use a cash forecasting model to manage the day-to-day cash requirements of the business.

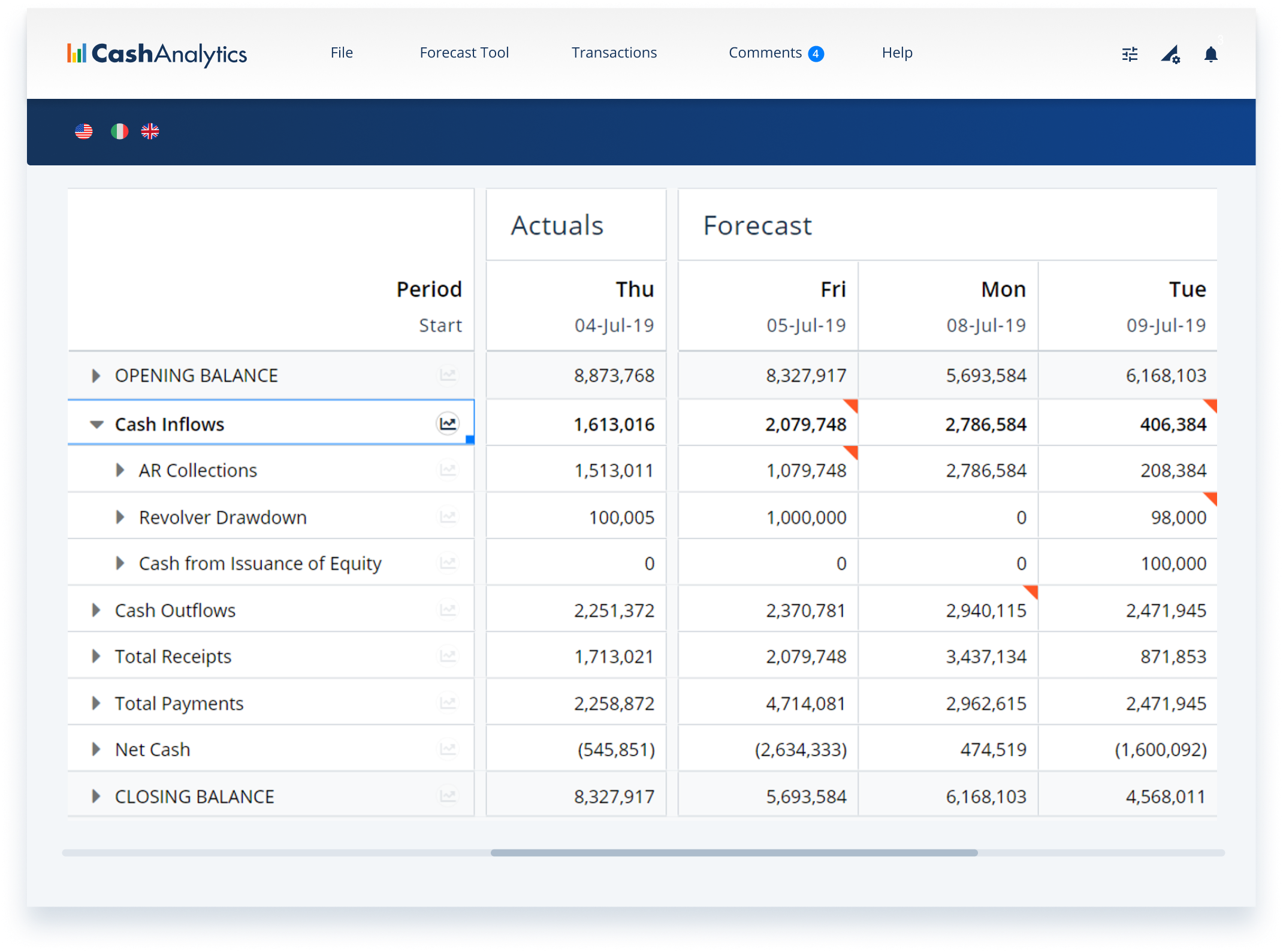

The screenshot below shows an example of a daily cash forecasting template, where each column represents a single day and each row details cash inflows and outflows in various categories:

Gaining an accurate view of liquidity levels on a daily basis requires a high level of detail and granularity. So cash flows are often tracked on a customer or supplier basis rather than broader cash classifications, such as trade payments or receipts.

Gaining an accurate view of liquidity levels on a daily basis requires a high level of detail and granularity. So cash flows are often tracked on a customer or supplier basis rather than broader cash classifications, such as trade payments or receipts.

Daily forecasting periods are best for reporting cash flows up to four weeks into the future.

Weekly Reporting

Weekly reporting classifies cash flow predictions on a weekly basis. Weekly reporting periods are particularly useful for companies that are planning for debt repayments, have debt covenants they must uphold from lenders, require reporting date visibility, or are trying to manage future liquidity risks.

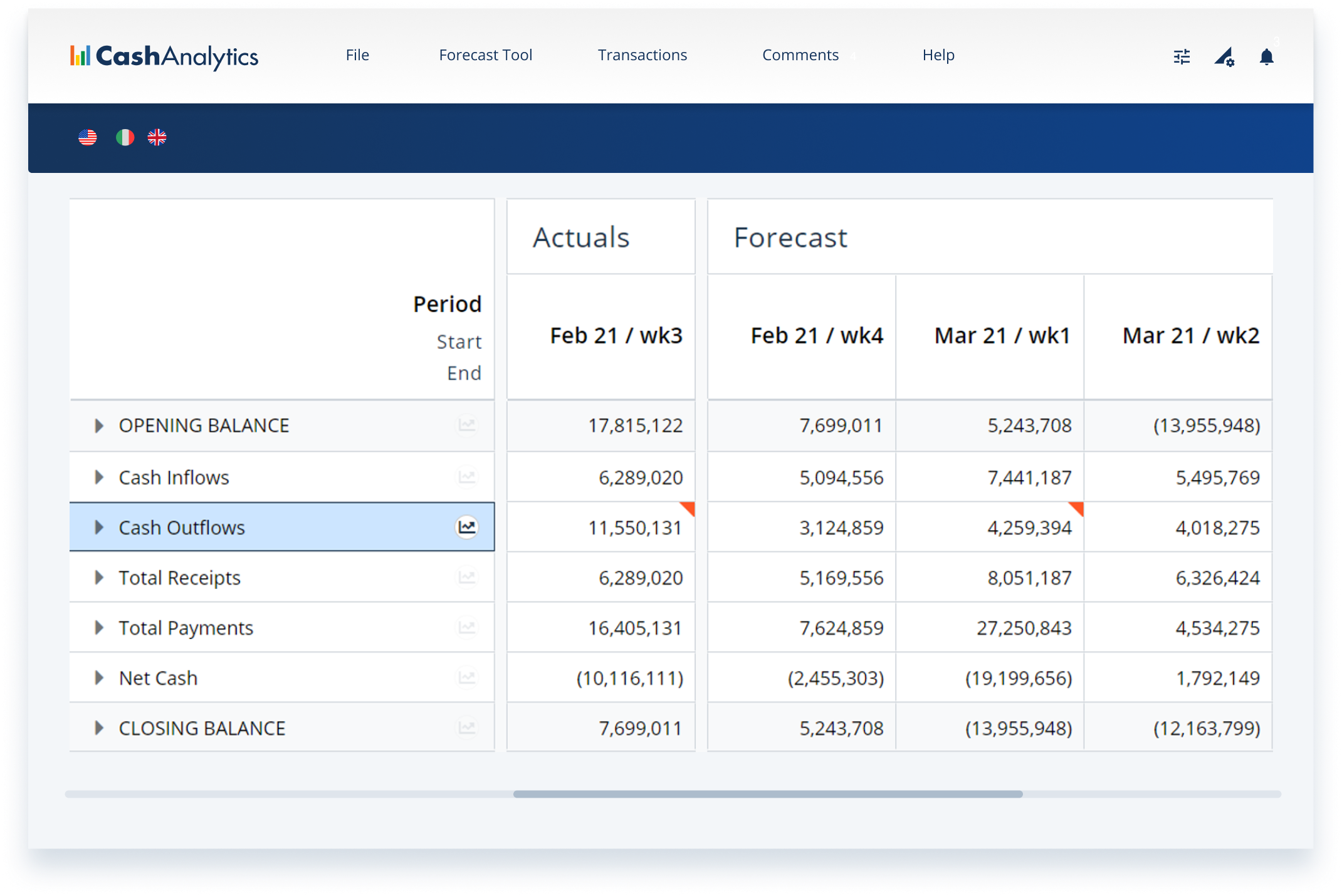

The screenshot below shows an example of a weekly cash forecast template, where each column projects cash levels for a different week:

The most regularly used weekly forecasting model is a 13-week Cash Flow Forecast because it provides both a reasonable degree of accuracy and a quarterly view of upcoming cash flows at all times.

Weekly forecasting periods are best for forecasting one to four months into the future.

Monthly Reporting

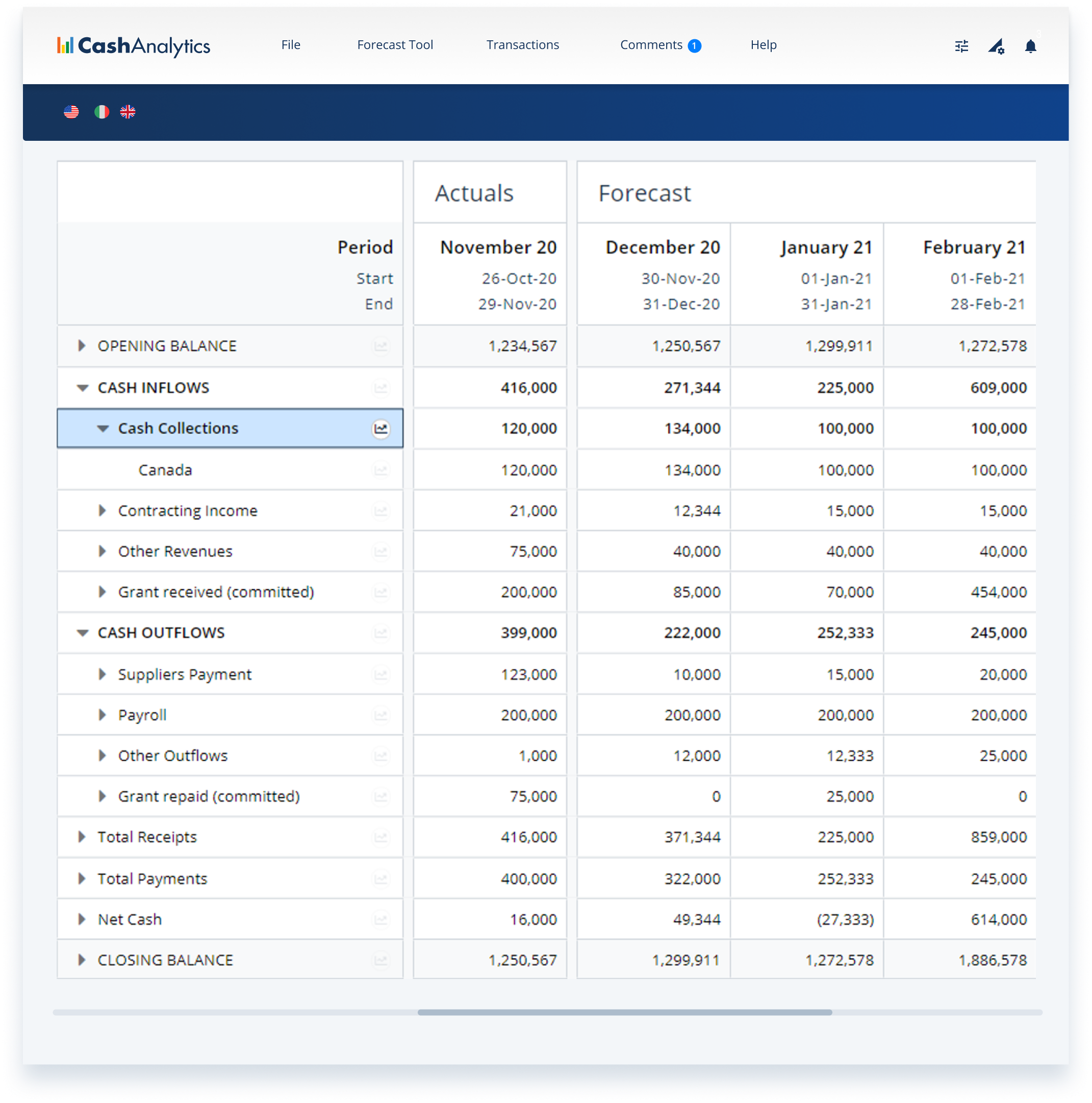

Monthly reporting classifies cash flow positions on a monthly basis. Monthly forecasting periods are ideal for longer-term planning purposes and are a logical extension of budgeting processes. The screenshot below shows an example of a monthly cash forecast template, with each column containing cash flows for a different month:

Monthly forecasting periods are best for forecasting 12 to 18 months into the future. But they can also be used as part of a mixed period forecast, where the first quarter is reported weekly and subsequent quarters are reported monthly.

3. Choose a Forecasting Method Based on Available Data

Your forecasting method is the data and data collection process you use to populate the cash inflows and outflows in your model. There are two forecasting methods you’ll need to choose between:

- Direct forecasting. Uses actual cash flow data from your enterprise resource planning (ERP) systems and bank accounts to populate your model. Direct forecasting is best suited for daily and weekly forecasting periods as access to accurate cash flow data more than 90 days into the future is often limited.

- Indirect forecasting. Compares balance sheets between accounts receivable or accounts payable to predict future liquidity levels. Indirect forecasting is best suited for medium to long-term views, as it doesn’t typically provide the kind of detail that short-term reporting often requires.

Generally speaking, direct forecasting is the most accurate method as long as you have access to actual cash flow and can collect it reliably (more on this next).

Use Automation to Improve Your Forecasting Model’s Reliability

Most organizations still manage their cash forecasting models manually in spreadsheets. And while spreadsheets are a fantastic tool that no treasury or finance function could run without, the manual work required to manage your model in a spreadsheet opens the door to errors. This is especially true in larger organizations where multiple stakeholders are involved in the data collection and manipulation process.

Simply put, your forecasting model will only produce reliable insights if the data you use to populate it is accurate. Automating the collection of cash flow data directly from ERP systems or bank accounts can decrease the likelihood of errors that could reduce its reliability, as well as save organizations more than 90% of the manual work it takes to keep their forecasting model(s) up to date.

To learn more about automating your cash flow forecasting process with CashAnalytics

Book a demo with one of our experts here