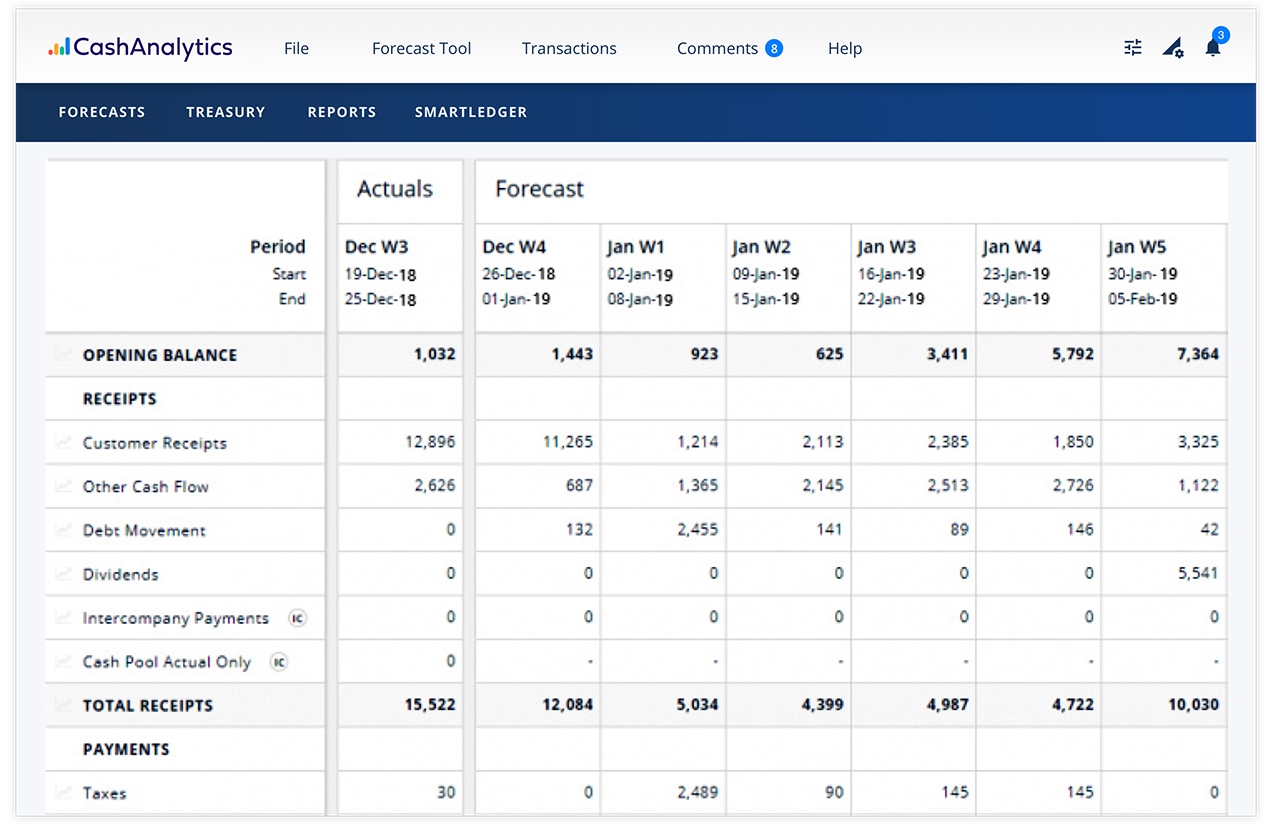

The all-in-one cash flow forecasting and cash reporting platform

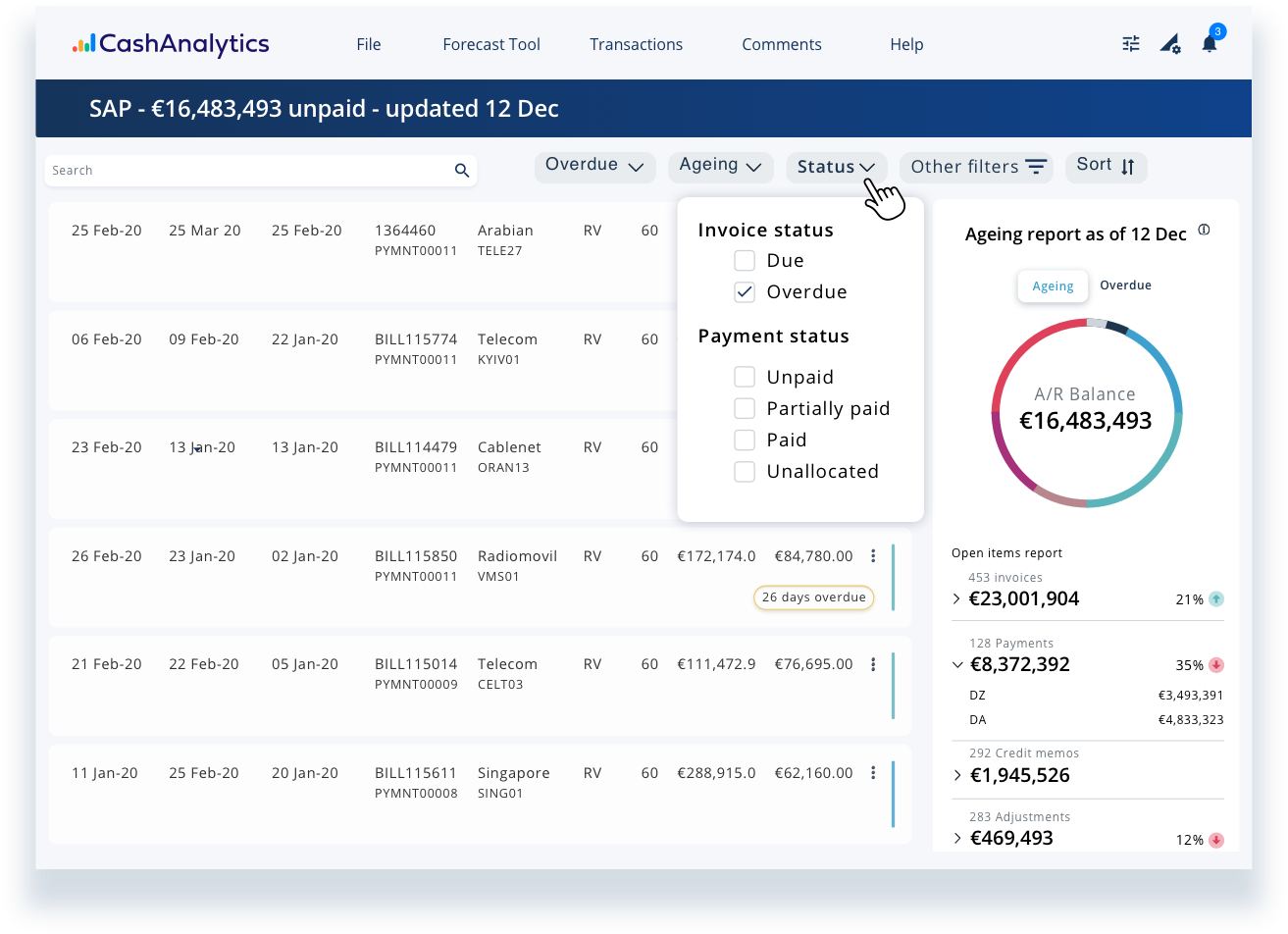

CashAnalytics is a cash flow reporting platform that automates cash flow forecasting, bank account reporting and working capital analysis.

By managing all of these activities in one place you get a single source of cash flow visibility while significantly reducing the amount of time and effort spent on manual cash forecasting, reporting and analysis tasks.