As part of our continuing series discussing how different time horizons can be used in cash forecasting, this post will explore the daily cash flow forecast in detail.

In this post we will review:

- The uses of a daily cash flow forecast

- Why companies set up a daily cash flow forecast

- How to build a daily cash forecast:

- The sources of data that feed a daily cash forecast

- What a daily cash flow forecast looks like

- The workflows around a daily cash flow process

- How to decide whether a daily cash forecast is right for your company

- How software can improve a daily cash forecast

What are the main uses of a daily cash flow forecast?

The main use of a daily cash forecast is short-term liquidity planning. The level of granularity produced as part of a daily cash flow forecasting process means that it can offer vastly improved financial control. This can be very useful for businesses operating on fine margins, or those working to tight working capital cycles.

The level of granularity afforded by a daily cash forecast also enables the kind of detailed guidance often required by shareholders or other investors. In addition, the level of data sourced from finance systems reduces the risk of human error.

As opposed to longer time horizons, a daily cash forecast allows greater levels of cash visibility. This means that, on a look-through basis, daily bank positions can be seen at an entity/business unit/departmental level. Each of these entities/business units can also have their respective cash positions forecasted as part of the overall daily cash forecasting process.

Generally, because of its shorter time-horizon, a daily cash forecast has a high degree of accuracy. It is this combination of increased accuracy and greater detail (when compared with other time horizons), that enables a much more proactive and tactical planning processes for short-term liquidity.

Why companies set up a daily cash flow forecast

The catalyst behind the decision to switch to a daily cash forecasting process can come from internal or external drivers.

External

- New credit agreement. A new credit agreement may include a covenant that stipulates that the total net cash position maintained by the group doesn’t go overdrawn.

- Revolving credit line. Making the switch to a revolver (maintaining an open credit line in return for monthly payments) as a funding mechanism usually results in a greater focus on daily cash planning and forecasting to assist with loan drawdown and repayment decision making.

Internal

- Excessive administration. Longer term forecasts are sometimes heavily reliant on human sources, whereas daily cash forecasts pull most (or all) of their data from system sources. This can result in a notable decrease in the levels of administration involved (particularly when specialist software is used, more on that below).

- Delays in longer term forecasts. The amount of time taken to produce forecasts with a longer time horizon may be affecting the senior management team’s ability to make timely tactical cash management decisions.

- Lack of visibility. If head office doesn’t have adequate visibility into all group accounts, a daily cash forecast may be requested to gain insight into all accounts across the group.

How to build a daily cash flow forecast

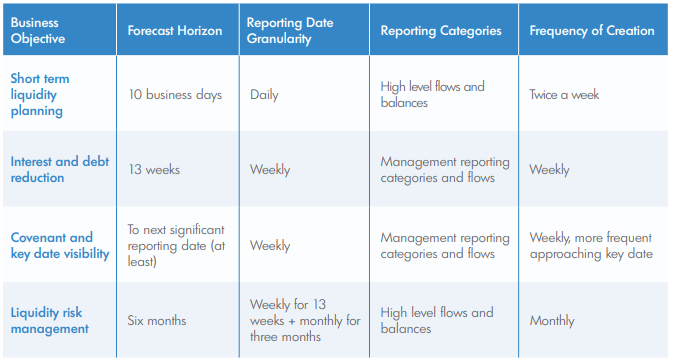

As is true when setting up any new cash flow forecasting process, it is important to begin by setting business objectives. To ensure that a daily cash forecast is the appropriate time horizon, these business objectives should map to the uses of a daily cash flow forecast outlined at the start of this article.

Sources of data that feed a daily cashflow forecast

The predominant difference between the sources of data used for a daily cashflow forecast versus longer-term time horizons is the amount of system data. Whereas longer-term forecasts (such as a 13-week cash flow forecast) are heavily reliant on human involvement, a daily cash forecast principally sources its data from system sources. Namely these are:

- ERP systems

- AP / AR ledgers

- Bank files (e.g. MT940 or BAI2)

- Payroll systems

- Billing systems

- Subsidiary data sources (e.g. CRM systems)

To expedite the forecasting process, all of these systems can interface directly with specialist forecasting tools (this is discussed in further detail in the section on software below).

What does a daily cash flow forecast look like?

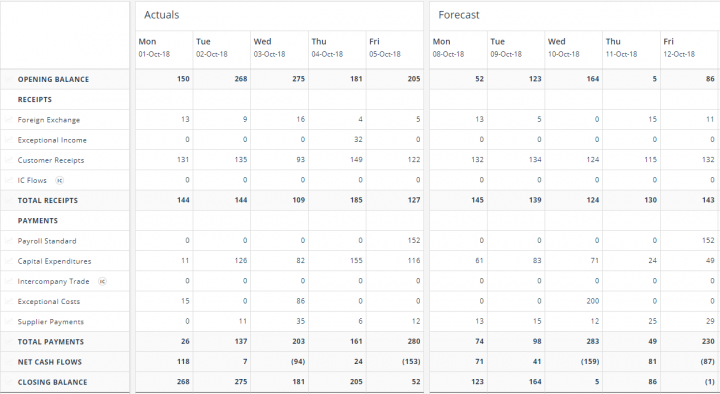

As with all types of cash and liquidity forecast, a daily cashflow forecast presents a high-level consolidated view of all of the data that was fed into the process. Therefore, the forecast is usually composed of (but not limited to): customer receipts, intercompany flows, investing data, and capital expenditure.

The above is a screenshot example of a daily cash forecast, showing forecast and actual figures (000s).

Because those choosing to set up a daily cash forecasting process do so because of the level of detail it provides, the base cash flow (line items) are quite often captured at a granular level. In other words, the individual line items showing customers’ and suppliers’ details displayed on a daily cash forecast would generally go into greater detail than they would on a longer-term forecast. In addition, bank account positions would generally be captured on a per account basis, and aggregated to a consolidated view.

As you would suspect, the main visual difference with a daily cash forecast is that the units of time captured are days. Typically, this view would extend two to four weeks into the future, although it is not uncommon that companies might extend this further. However, if a longer view is required (for example, if it is needed to extend beyond six to eight weeks), a longer-term time horizon might be more appropriate for the business requirements.

Workflows around a daily cash flow forecasting process

Many of the workflows that support a daily cash forecasting process are the same as those that support longer-term forecasting. However, the principal difference with daily cash forecasting is the frequency with which these workflows run.

Generally, a daily cash flow process means that data will be updated on a daily (although sometimes weekly) basis. The cycle is usually controlled by head office, that is to say the underlying entities each align with the requirements set by head office.

For large, multinational companies, this often means that data is updated multiple times in a 24-hour period. Depending on the business, is this is sometimes completed on a “follow the sun” basis, whereby each business unit updates the data during its own working hours.

It is important to note that, for larger companies, global business units are often running on multiple ERP systems with multiple bank partners. This means that the software systems used to support the workflow must be able to cater to this need.

How to decide whether a daily cash forecast is right for your company

Start with the objectives

It is important to consider the objectives of the cash forecast when assessing which time horizon will be best. If considering a daily forecasting process, it is important to confirm that those objectives map to the uses outlined at the beginning of this article.

An outline of model structure examples (taken from our cash flow forecasting setup guide) can be seen below:

If a longer time horizon is being considered, you may wish to view our article on the benefits and uses of a 13-week cash forecast.

The benefits of software

All cash forecasting processes can be improved with the use of specialist cash flow forecasting software, however a daily cash forecast in particular benefits from integrating a software solution.

To illustrate, let’s review the elements of a daily cash forecasting process discussed in this article and address the practical ways software improves the process:

Automated system data upload

As mentioned earlier in this article, one of the unique features of the daily cash forecast is that data is sourced principally from systems. The use of software means that the extraction of all of this data can be automated. (This point is examined in further detail in this post on cash forecasting automation.)

Automating this data upload process also means that the frequency of refresh required becomes a non-issue.

Enhanced analytic insight

In addition to the decrease in the administration required at the front end of the process, software can greatly improve the analytical capabilities when reviewing the data produced.

As we discussed in an article on cash forecasting data visualisations, the way software can present data graphically greatly enhances the ability to highlight trends, identify anomalies, and uncover insights that will be missed when simply reading through raw data.

Increased visibility

If the head office finance or treasury team is struggling to gain visibility into the cash positions of the underlying entities, software can enable real-time views of all bank accounts on a consolidated basis (as well as on a granular level, where drilldown is required).

Process workflow management

Automating the workflows that support the daily cash forecasting process can also alleviate much of the administrative burden placed on head office finance and treasury teams. For example, automated reporting workflows mean that scheduled reporting emails to relevant stakeholders can be generated and sent directly from the system as new forecasts are produced.

About CashAnalytics

CashAnalytics has helped many companies across a broad range of industries to build and maintain best-in-class cash forecasting processes that produce the highest quality reporting and analytics outputs.

If you would like to see a demonstration of how software and automation can improve your cash forecasting processes, or would like to see the business case for introducing CashAnalytics to your company, please contact us directly.