Working with treasury and finance teams across the globe, we see a large number of cash forecasting processes with varying degrees of automation. Some are fully automated, “no touch” processes, some deploy automation at key steps in the process, while others are fully manual, labour intensive processes. In this post we look at what forecasting automation is, what the benefits of automation are, which components of the process can be automated, and how cash forecasting automation can be achieved.

What is cash forecasting automation?

There are many workflows, data inputs, and communications and reporting exercises that make up a cash forecasting process. Cash forecasting automation may refer to automating the process in its entirety or may refer to the automation of the constituent parts of this process.

As mentioned above, the extent to which the process is automated, and indeed how the process is automated, fall on a spectrum. Some parts of the cash forecasting process may be automated with Machine Learning (ML) or Artificial Intelligence (AI) technologies, or those technologies may be used at the end of the process and deployed more on the output. This post focuses on how cash flow forecasting processes can be automated without ML/AI. For further reading on how ML/AI can be used in cash forecasting, we have written an article discussing how ML/AI methods of forecasting compare with traditional statistical ones, which explores the topic in further detail.

How can automation benefit treasury and finance teams?

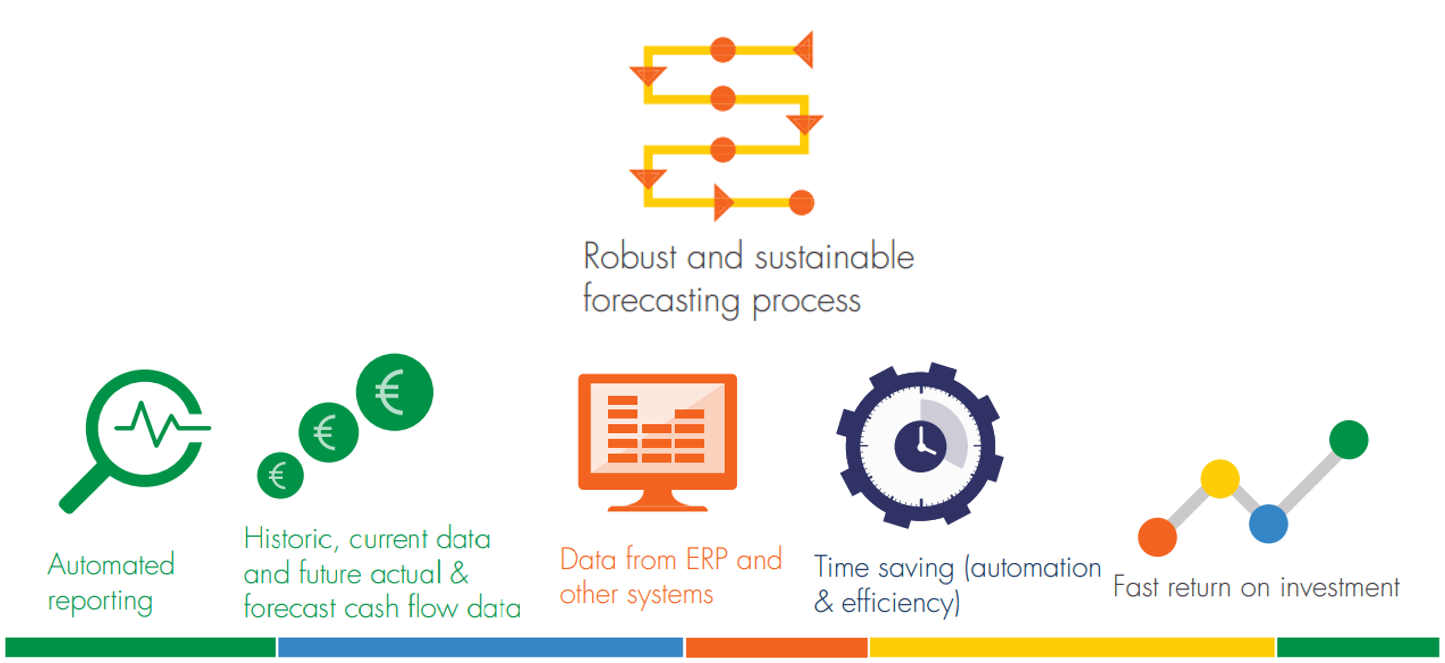

Automating the cash flow forecasting process brings many benefits, namely:

- Risk reduction. Automating part or all of the process reduces the risk of human error, thereby improving confidence in the forecast.

- Increased efficiency. Treasury teams, even those in the largest organisations, are often small. Automation can therefore increase efficiency and alleviate an overburdened workload. In turn, this changes the focus of activities from administration to analytics.

- Improved quality. When the process is carefully designed and mapped from the outset, automation can leverage data already in the corporate technology infrastructure (TMS systems, ERP systems, bank systems, etc.). This, when combined with the factors listed above, means that automation can substantially improve the quality of the forecasts produced.

The result of these benefits is that automation doesn’t just mean fewer mistakes, when applied well, it leads to a roundly improved, best practice forecasting process.

Input data automation

Typically, there are two sets of data collected in a cash forecasting process, the forecast data and the actual data. Automating the input of this data to the process encompasses both the collection and classification of this data. This be achieved by either algorithmic or rules-based classification.

Forecast cash flow data

- Accounts payable/accounts receivable. Forecasting AP and AR is an integral part of the cash forecasting process. Quite often, short-term payable and receivables are already recorded in ERP/accounts systems. If this data is available, it is therefore beneficial to include it in the forecast process. For more information, read our post on increasing accounts receivable forecasting accuracy.

- Budgeting/planning systems. Longer-term forecasted cashflows may be contained in budgeting/planning systems.

- Treasury Management Systems (TMS). Depending on the system, and how it is being used, the TMS may also hold some of the required forecast cashflow data (such as financing or intercompany cashflows).

Actual cash flow data

- Bank account data. Most commonly stored in MT940 or BAI2 files, automating bank account inputs means identifying and extracting the relevant information automatically.

- ERP/TMS systems. In a similar way, actual cash flow data can be pulled automatically from these systems and fed directly into the cash forecasting process.

Workflow automation

Without automation a cashflow forecasting process for head office teams can involve significant manual work, therefore automating key workflows can alleviate much of this administrative burden.

Input workflows

- Automated submission management. When a new submission cycle is due, an automated process; sets up the new version, triggers any required actions (such as reminder emails), and catalogues the version accordingly. This automatic versioning enables an easier forecast vs forecast, and forecast vs actual analysis, once the version is complete.

- Automated workflow triggers. For example, one of the key workflows at the beginning of the process is to send reminder emails to all contributors, informing them that a new submission is due, prompting them to input any and all required data. With automated workflow triggers, these emails can be generated and sent within the system automatically. In addition, approaching a deadline date, users can be prompted by further automated reminders.

- Variance justification. Where users have submitted data that exceeds a predetermined threshold, an automated system can detect the variance and prohibit it from being submitted without a comment to explain the variance. In this instance, a user would be required to provide feedback on why the threshold had been exceeded before the submission could be made.

- Intercompany reconciliation. Intercompany reconciliation can be a very time consuming and laborious task for a company’s head office finance team. To automate this element of the process, the full process must be designed in a way that considers the automation of intercompany reconciliation up front. For example, the system could be built to include a full counterparty driven process or process where the reconciliation and variance reporting is systemised.

Output workflows

- Real time feedback. When actual cash flows are updated (whether manually or collected automatically) a feedback notification can be issued automatically informing the user of any variation to the forecast. This enables quick and easy amendments to forecast figures, thereby improving accuracy.

- Reporting and analytics automation. Where the process is automated, scheduled reporting can be automatically generated from the system and circulated to key stakeholders as required. For example this might consist of a weekly or daily cashflow report, bank account reports, or reports on funding requirements.

Using specialist software

As discussed above, a cash forecasting process can be automated in its entirety, or it can be separated into its constituent parts, which can each be automated in isolation. In either case, automation is difficult if not impossible to achieve without the use of specialist cash flow forecasting software.

If you are setting up a new cash flow forecasting process, please read our Cashflow Forecasting Setup Guide.

If you have any questions, or would like any advice on how to automate any or all of the elements of your cash forecasting process, please do not hesitate to contact us.