Corporate liquidity is unlikely to ever be subject to the same degree of regulation as its banking equivalent.

However, in a post-COVID-19 world, I expect to see senior executives, shareholders and boards demand the implementation of governance structures that codify how cash and liquidity are managed within their organizations.

Banks, of course, must abide by liquidity regulations set and monitored by external bodies, but a framework for liquidity governance – a subsection of liquidity risk management – will also have an internal ‘regulatory’ impact on any business that decides to establish one.

At CashAnalytics, we’ve already noticed a subtle shift in this direction, and the findings of the most recent PWC CFO survey1 add some weight to our observation.

Systemic Impact

It is worth noting, given the current moment, that corporate liquidity often has a systemic impact. Not to the same extent as banks but few companies are islands – fractured supply chains can have a far-reaching ripple effect.

And novel though it might seem, a Liquidity Governance Framework (LGF) would actually be analogous to Enterprise Risk Management and Data Security Risk Management Frameworks. Both of which are used by most businesses, and both of which have been shown to fulfill their function to great effect.

Ensuring a Business is Always Protected

If it has not already, this crisis will forever change corporations’ attitudes to cash and liquidity management. This change, I believe, will be a catalyst for the highest levels of management to take a more active, permanent role in the oversight of their company’s daily cash and liquidity activities.

This oversight will need to be governed by a framework that entails clear guidelines as to how cash should be managed and, in particular, what resources can the business avail of in times of extreme stress.

This framework will also map out the full cash flow ‘supply chain’ in a business and identify responsible personnel for each link in the chain, as well as choosing, then implementing, the appropriate systems and technologies.

Moreover, the Liquidity Governance Framework will set out how the organization responds to shocks that impact liquidity. This includes both outlining the direct actions that are taken during periods of stress and the liquid resources that must be maintained at all times.

Ultimately, if implemented correctly, I am confident this framework has the potential to ensure businesses are always protected, no matter the circumstances.

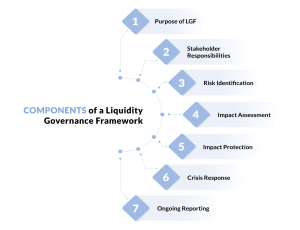

Below, I have detailed the seven components all Liquidity Governance Frameworks should include.

1. Purpose of Liquidity Governance Framework

The objective of the LGF must be communicated to key stakeholders and contributors with the utmost clarity if it is to be effective and ultimately succeed. Ambiguity is the enemy.

Simply put, the LGF’s sole purpose is to ensure the business always has sufficient liquidity to remain a going concern, and every action taken within the framework must serve this purpose.

Once the core purpose of business protection has been achieved and verified, the LGF can also be used to guide cash and liquidity usage across a range of other activities, such as working capital and investment.

2. Stakeholder Responsibilities

For any framework to be effective, each activity must be delegated, and the responsibilities of all stakeholders made abundantly clear.

The stakeholders in an LGF will range from the most senior levels in an organization to the people and teams managing cash on a day-to-day basis.

The key stakeholders in an LGF are:

3. Risk Identification

Where do liquidity risks lie within your organization? These can typically be broken into two categories; working capital and funding risks

Working Capital Risks

This is the risk that something in your day-to-day working capital cycle changes, then has a detrimental impact on cash flow. This could be the loss of a key customer or non-payment by a customer. Or, to a lesser extent, ongoing late payment by a customer.

What impact does this have on liquidity? And what happens if groups of customers or large segments of the business are impacted at the same time?

On the cost of goods side of the equation, what will transpire if a key input price spikes in value or if a key supplier fails, and therefore, you can’t fulfill your production requirements? Furthermore, what impact will this have on cash flow?

There are cash flow risks at each link of the working capital chain. Individually or in isolation, working capital shocks can typically be managed or compensated for.

But when the perfect storm arrives, such as COVID-19, any weakness in the working capital cash flow chain will be cruelly exposed.

External Funding Risks

This is the risk that external funding can’t be secured or rolled over in the first instance or accessed when needed in the second.

The credit lines provided by banks and other external financial institutions are critical funding for many businesses. They act as a key source of day-to-day liquidity, supplementing working capital, while also providing a buffer in times of need.

The failure of a credit providing bank or financial institution will impact a company’s ability to access liquidity. Similarly, the failure to rollover or extend a credit facility will severely impact the liquidity reserves of a business.

4. Impact Assessment

When the key risks to a business’ liquidity are identified, their impact must be assessed, quantified and analyzed under a range of different scenarios – including separate or seemingly unrelated risks occurring simultaneously.

Taking two of the risks outlined above – the failure of a key customer and the failure of credit providing institution – what would be the impact on the business from a liquidity perspective?

5. Impact Protection

The optimum way to protect a business against a shock that impacts liquidity is to maintain reserves of liquidity that will cushion even the most seismic of economic events, namely a global pandemic that severely decimates demand.

Of course, this liquidity has an opportunity cost during a healthy business cycle. However, the value of a liquidity buffer can never be truly appreciated until it’s needed. The current environment should make its value very clear.

There are numerous other ways to protect against a shock, such as diversifying a customer base and improving collections and credit processes. Forecasting, too, is fundamental, so that cash is efficiently managed from day-to-day.

6. Crisis Response

Most companies, even if they don’t put an LGF in place, will need to establish a Liquidity Continuity Plan, which will serve as the “break the glass” response to an emergency similar to COVID19.

A Liquidity Continuity Plan is equivalent to a Business Continuity Plan and sets out very clear guidelines on how cash and liquidity should be managed during such a period.

The Liquidity Continuity Plan should outline, among other things, the following:

- Who leads the crisis response

- Who else in the company is involved in the effort

- How supplier payments should be managed

- How other non-operating payments should be managed (Capex etc.)

- When external credit lines should be drawn

- What elevated reporting will be needed during the crisis period (e.g. more detailed and more frequent AR analysis and forecasts)

7. Ongoing Reporting

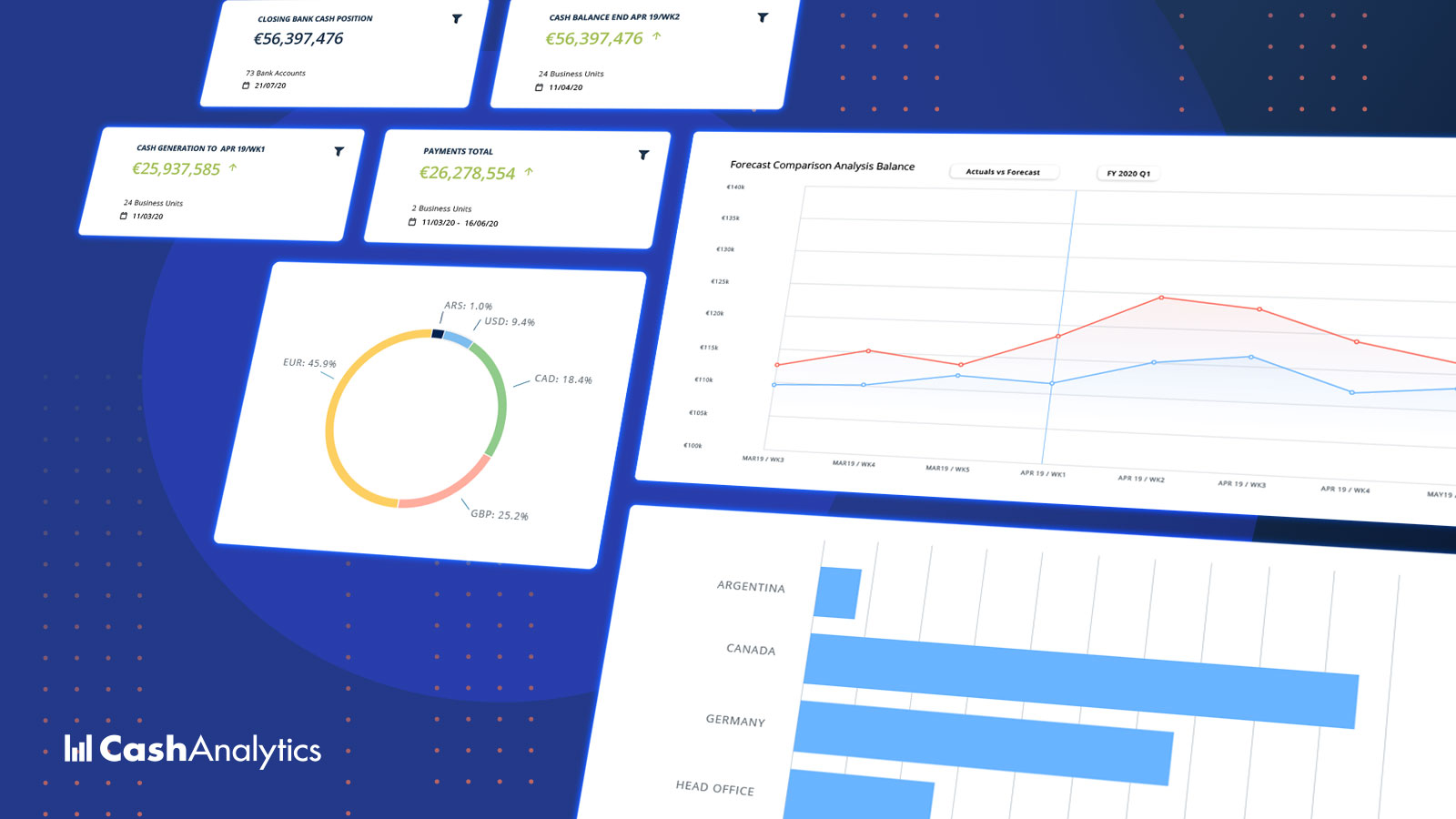

Clear ongoing cash and liquidity reporting is the backbone of any Liquidity Governance Framework. Daily, weekly and monthly cash reporting processes should be amalgamated into a cohesive framework that gives all stakeholders access to the information they need.

The cash and liquidity reporting framework should include:

- Daily bank account position reporting

- Weekly short to medium term (one quarter) forecasting

- Weekly forecast variance and analysis reporting

- Weekly debtor and credit analysis

- Monthly management reporting

- Quarterly board reporting

PWC CFO survey1 https://pwc.to/2VrlXvK

Conor Deegan is the Managing Director and co-founder of CashAnalytics.

We believe that the governance of liquidity risk management will, in the aftermath of COVID-19, inevitably become a central facet of the financial operations of global corporations. We plan to further explore this topic and would encourage anyone who wishes to join the discussion to contact us directly.