Following a COVID induced boom for most of 2020 and 2021, big tech suffered a bruising 2022. Apple, Microsoft, Alphabet (Google), Meta (Facebook) and Amazon have all reported results over the last couple of weeks that have given a better insight to the impact of the downturn on business.

Last week Google reported a 4% contraction in advertising revenue in Q4 2022, only it’s second quarterly contraction ever. Its parent Alphabet reported a 1% revenue increase for the year, down from 32% growth the year before. Apple posted a revenue decline for the same period, caused by supply chain issues, and both Microsoft and Amazon reported softening demand for their fast-growing cloud services.

As demand for these services digital services drop in the face of tougher economic conditions, hitting revenue and income, how have the cash and liquidity reserves of the big tech firms been impacted.

So, how much cash do they have?

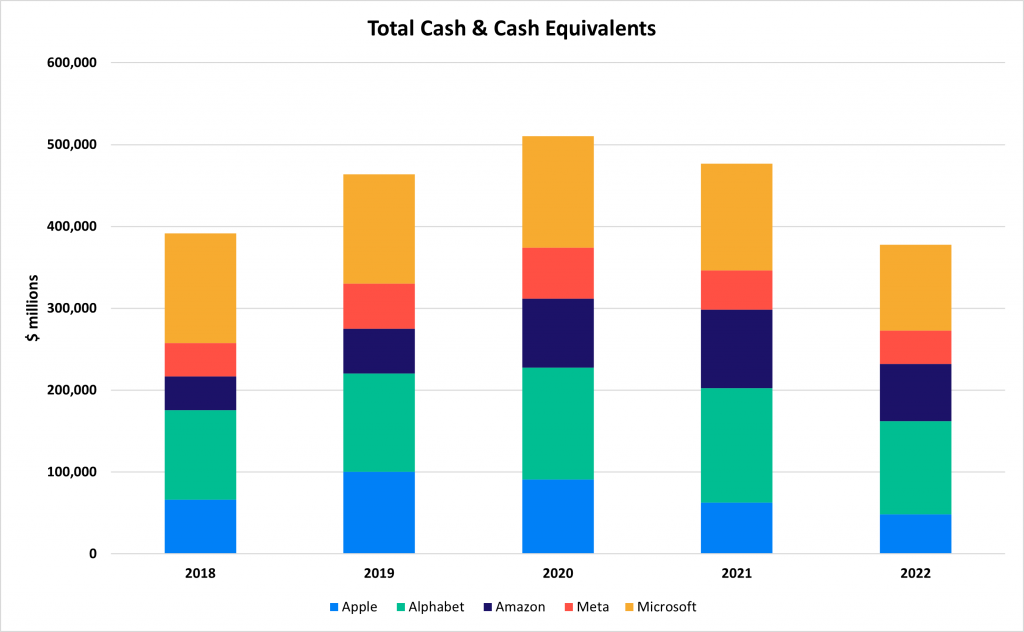

The five firms making up our Big Tech analysis carried record cash reserves into the pandemic in 2020 and finished the year in an even stronger position with over $513bn in combined cash and cash equivalents. This is made up of cash and highly liquid securities such as US Treasury bonds.

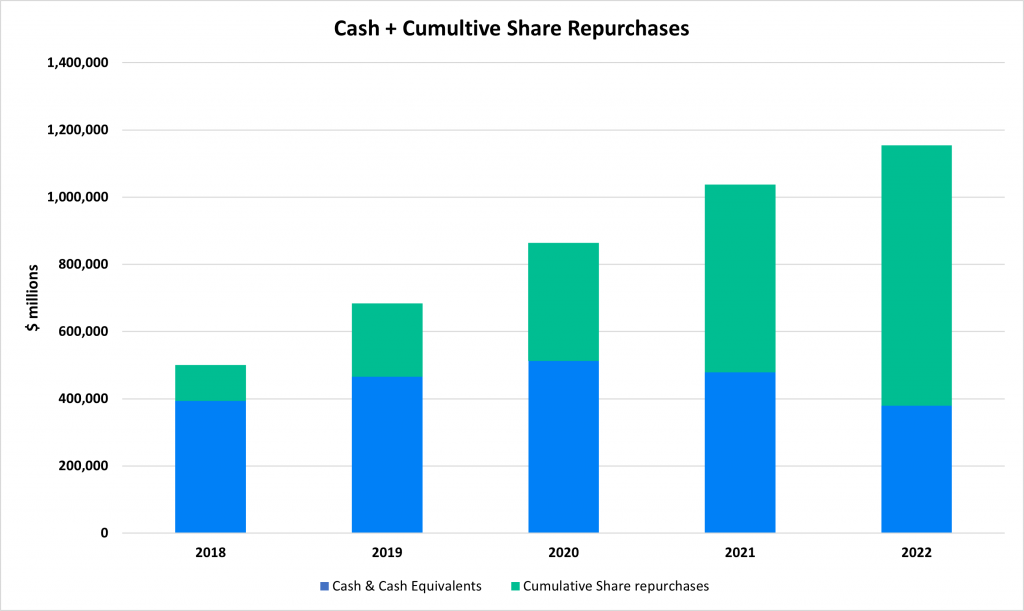

Since the 2020 peak, total cash and cash equivalents have dropped by over 25% and now stands at combined total of $379bn based on the last reported full year accounts of each firm. This means that cash reserves have dropped to pre-2018 levels.

No doubt the drop in earnings and cash generated combined with the increase in costs driven by record breaking hiring has impacted cash on hand. However, each company’s core businesses continue to generate huge amounts of cash. Therefore, when looking to understand what impacts net overall cash flow, it’s important to explore how much they return to investors via share repurchases as this is the big non-operating cash out flow in most cases.

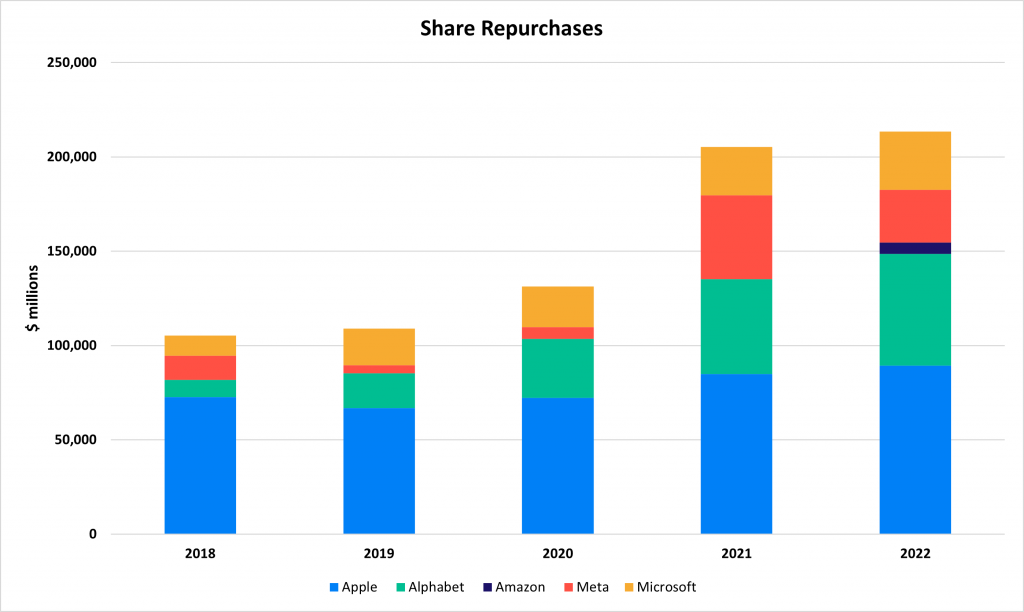

The $750bn share buy-back

Share repurchases and buybacks have been the most popular way to return cash to investors over the last decade. In the last five years, the Big Tech companies have repurchased close to $775bn of common stock, with Apple making up 50% of this number. These repurchases directly support the price of a stock and the numbers ignore dividends which some of the firms also pay.

Repurchases are funded directly from the cash and cash equivalent reserves of the business and liquid assets therefore reduce in line with cash spent buying back stock.

Theoretically, these repurchases can be turned off quite quickly to shore up cash reserves. Investors, used to strongly supported share prices, would no doubt react negatively to this, nevertheless, it’s a valuable lever to have.

How much cash could they have?

How much cash would the Big Tech companies have if they hadn’t returned so much to investors in recent years? Slightly under $1.2trn. This takes the current total cash and cash equivalents balance and adds the cumulative share repurchases over the last five years. Of course, some of these firms have been buying back stock in the years before so this number could be bigger. However, it shows the amount of cash they have had to play with in recent years and how much relative to their overall reserves they have been returning over the period.

Coming into a tougher economic climate with lower demand and higher costs, the question is whether the Big Tech companies will continue to repurchase shares at the same pace and instead use cash generated to buffer their balances sheets. It’s likely as revenue and earnings reduce, or at least don’t grow as quickly, the growth in share repurchases will also slow. One thing is for sure however, the big five tech firms won’t be running out of cash any time soon.

Need better cash visibility and forecasting?

CashAnalytics is a cash forecasting and liquidity planning platform designed for mid-market and lower large cap corporates who want to take a professional approach to cash management.

Plug into your banks and ERP systems to automate manual and time-consuming cash forecasting tasks while getting clear and accurate visibility over current and future cash flow.

If you’re interested in seeing CashAnalytics, feel free to sign up to a demo here.