A cash flow forecast is a tool used by finance and treasury professionals to get a view of upcoming cash requirements across their company. The main purpose of cash flow forecasting is to assist with managing liquidity. The larger the company, the more complex and challenging cash flow forecasting becomes.

In this post, we look at the main components of a cash flow forecast, the importance of actual cash flow data, and a number of different types of cash flow forecasts.

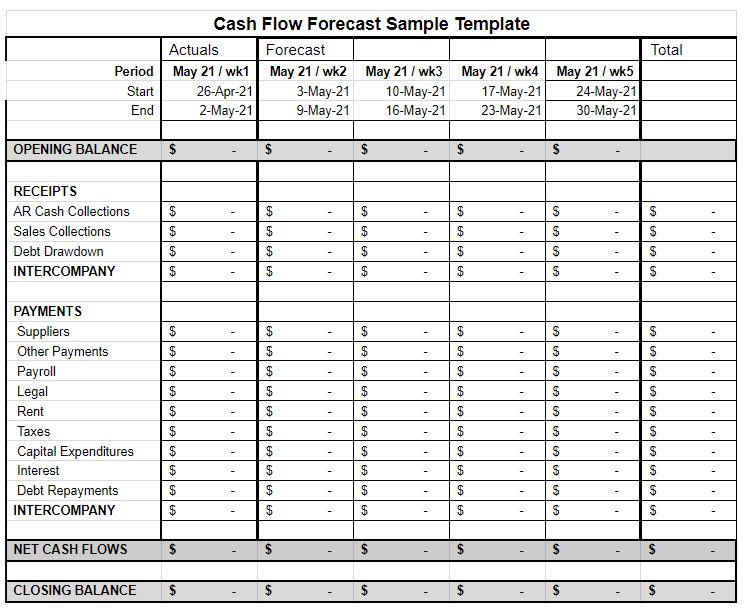

We also provide examples of types of cash flow forecasts and a template to help you better organise and interpret cash flow data.

Components of a Cash Flow Forecast

In its simplest form, a cash flow forecast will show you where your cash balances will be at certain points in the future. This helps highlight when and where funding needs arise and allows you to take advantage of times when excess liquidity is available. A more comprehensive cash flow forecast will show you where your cash is right now, if you’ll have enough cash in the future, where it’ll be, and what will happen along the way (e.g., classified cash receipts and payments).

Typically, a cash forecast will contain some or all of the following components:

- Opening Balance for the period;

- Receipts — broken down by cash flow item/classification;

- Total Receipts;

- Payments — again broken down by cash flow item;

- Total Payments;

- Net Movement — either by individual cash flow item or at a minimum total net movement;

- Closing balance for the period.

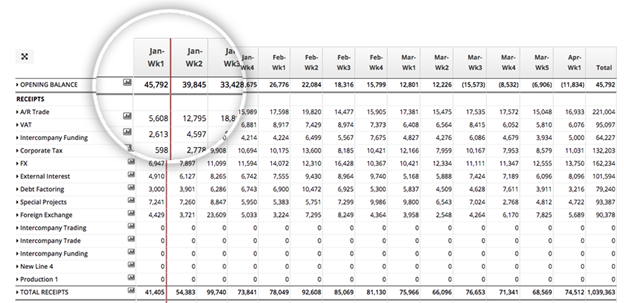

Broadly speaking, most cash forecasts will be structured as shown below. The image shows a cross-section of a 13-week cash flow forecast:

The cash flow items that make up the receipt and payment elements are unique to a company’s forecasting needs. For example, some companies would track high-level Accounts Payable/Accounts Receivable cash flows, and other companies would break the cash flows down to the level of individual customers and suppliers.

Why Is Cash Flow Forecasting Valuable?

As well as capturing forecasted positions, cash flow forecasts often capture actual cash flows in the same model or template. In the example above, the numbers left of the red line are actuals.

There are several benefits to capturing actuals in cash forecasting:

- It ensures that the projected cash flows are starting from the actual cash flow position.

- Historical cash flow data provides a good basis for making future projections because it reveals patterns in the fluctuation of cash on a monthly or yearly basis. Those can be used to predict future cash flow.

- Capturing actual cash flows means that you can compare what was forecasted to what was actually received, allowing you to analyse the accuracy of the previous forecasts.

- It helps companies avoid shortfalls and negative cash flow by predicting how much cash will be available in months to come. If there is a shortage of cash, controllers can figure out ways to get cash before it’s too late.

Types of Cash Flow Forecasts

When setting up a cash flow forecast, you first have to decide how far into the future the forecast will look. This will be determined by business needs and the availability of information within your organisation. Generally, there is a trade-off between the availability of information and forecast duration. The longer the forecast, the less detailed it is likely to be.

Short Term

Short-term forecasts are used to manage the day-to-day cash needs of a business. Typically, they look a couple of weeks into the future and contain a daily breakdown of the amount of cash on hand and receipts.

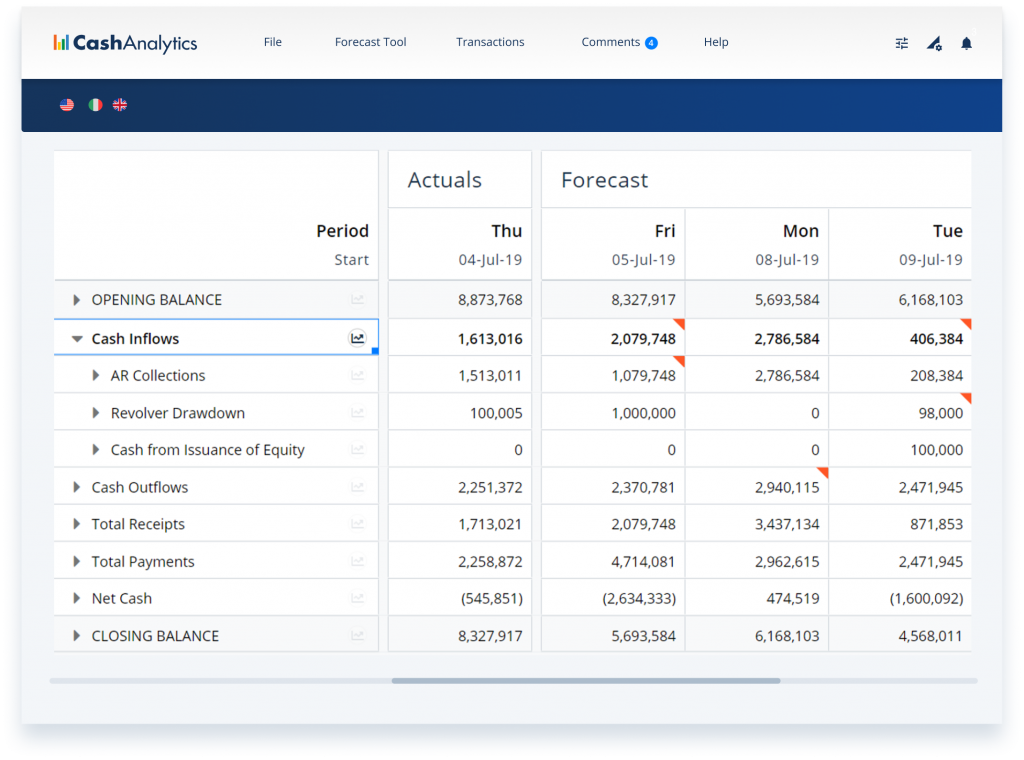

A daily forecasting process would often include a degree of automation in capturing cash flows from bank accounts and ERP systems. Short-term cash flow forecasts provide important information for small business owners because they show cash inflows and outflows as they occur.

With more accurate information available, small business owners are able to make better planning decisions. Small businesses especially need to know how much they’ll have available to pay suppliers and for other bills. They often don’t have as much credit to cover expenses as larger businesses if they fall short.

This example covers what a daily cash flow forecast would look like.

Medium Term

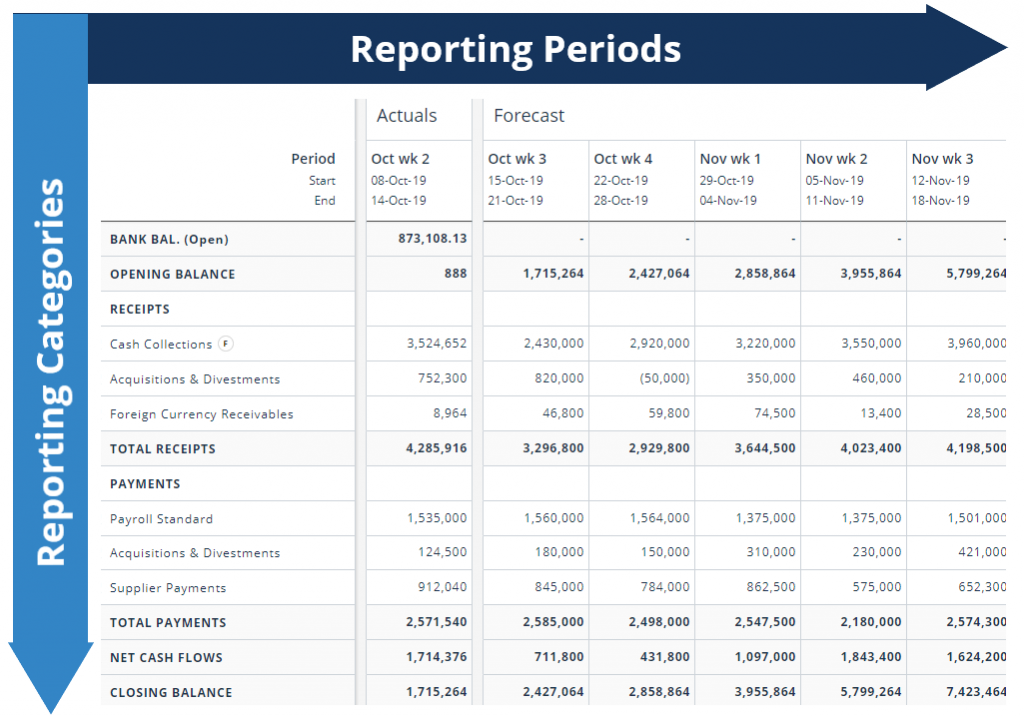

Medium-term forecasts such as rolling 13-week or monthly cash flow forecasts are extremely useful from a liquidity planning perspective. The 13-week period is important as it gives a quarterly view for each submission.

Most organisations rely on accrual-based accounting, which records income based on the invoice date as opposed to the date the invoice is paid. Accrual accounting does not give the most accurate picture of cash on hand. Medium-term cash flow forecasts account for this discrepancy in invoice date and payment date. They help make sure there’s enough cash to pay the bills.

Long Term

Longer-term forecasts, such as a 12-month forecast, are often the starting point for a budgeting process and are important tools for assessing the cash required for longer-term growth strategies and capital projects. The benefits of a long-term forecast need to be balanced against the dependability of forecasts over a long period of time.

Financial leaders don’t want to depend too heavily on these projections for month-to-month decisions because it’s an extended forecast, and the cash flow data isn’t always updated month by month. Instead, long-term forecasts are helpful to get a big picture idea of how much capital will be necessary in the upcoming year.

Mixed Period

Mixed-period forecasts involve a combination of time periods. For example, a forecast spanning six weeks in total could contain two weeks of daily cash flows and four weeks of weekly cash flows. This approach ensures detailed visibility where it matters most. Controllers and accountants get value out of a mixed-period forecast because it allows them to zoom in on one specific time period while maintaining a big-picture view.

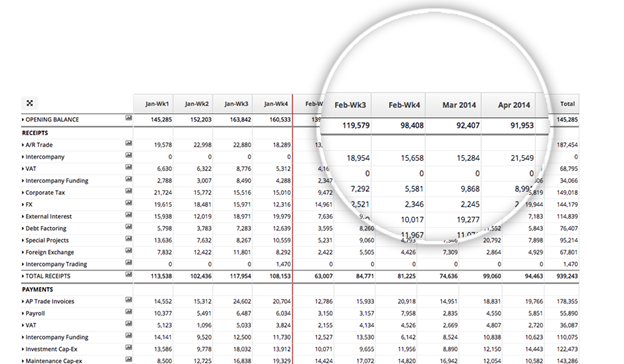

An example of a mixed-period cash forecast is shown below. This example covers a period of four months where cash flows are captured weekly in the first two months and monthly thereafter.

In most companies, forecasts are collected on a weekly or one-month basis from business units. Forecasts can either be rolling or fixed term. A rolling cash flow forecast extends with each new submission, and a fixed-term forecast counts down to an end point, such as quarter or year-end.

How Do You Forecast Cash Flow?

To maximise the value of your cash flow forecasts, review your goals and business plans and base the framework of the cash flow forecast around those. Some factors to consider include short-term liquidity, interest/debt reduction, and growth planning.

Once you define an area of focus for the cash flow forecast, select a time period to complete the forecasting. Refer to the section above to pick the best one for your organisation.

You also need to decide if you’ll use an indirect or direct forecasting method. Direct forecasting relies on data that are updated daily or weekly, while indirect uses projections and income statements. For short-term cash flow projections, pick direct forecasting since it relies on shorter-term data. Indirect forecasting is better for planning and budgeting because it uses data from a certain time period, like a month or 90 days.

Finally, source the data from your accounting software or bank accounts (if you’re a small business without such software). The information you’ll need includes:

- Cash flow statement with opening balance for the forecasting period

- Cash inflows for the forecasting period

- Cash outflows for the forecasting period

Using a spreadsheet to track all this information initially is a solid way to start. But when the projections start to become lengthier and more detailed, it’s not always the best solution to keep track of and update. As your company scales, consider implementing better tools. With a platform to manage cash flow like CashAnalytics, forecasting is automated and simple.

CashAnalytics automatically pulls bank and ERP data and mitigates the need for controllers to gather it from each source and compile it themselves. Our platform helps businesses store their cash flow data centrally and cuts down on the time controllers spend forecasting by 90%.

Kickstart Your Cash Flow Forecasting Process With Our Free Template

Cash flow forecasts are the main tool used by companies for forward liquidity planning. Their format and duration vary depending on the exact nature of each business’s requirements. Finance teams structure their cash forecasts depending on what makes sense for them and what is important for the Treasurer, CFO, and ultimately the CEO. A robust and accurate cash flow forecasting process, where accountability is built in, is an indicator of strong fiscal discipline in a company.

If you’re looking to get started with cash flow forecasting, this simple template will help. It lets you make cash flow projections on a weekly basis and includes spaces to fill out receipts, payments, expenditures, net cash flows, and closing balances.

Open it here. To access and edit it from your own drive, make a copy or download it as an Excel file.