Use Cases

Automated cash flow forecasting changes the way people work across teams and drastically reduces time spent on manual, time consuming tasks, making room for higher value cash and liquidity management activities.

Automated cash flow forecasting changes the way people work across teams and drastically reduces time spent on manual, time consuming tasks, making room for higher value cash and liquidity management activities.

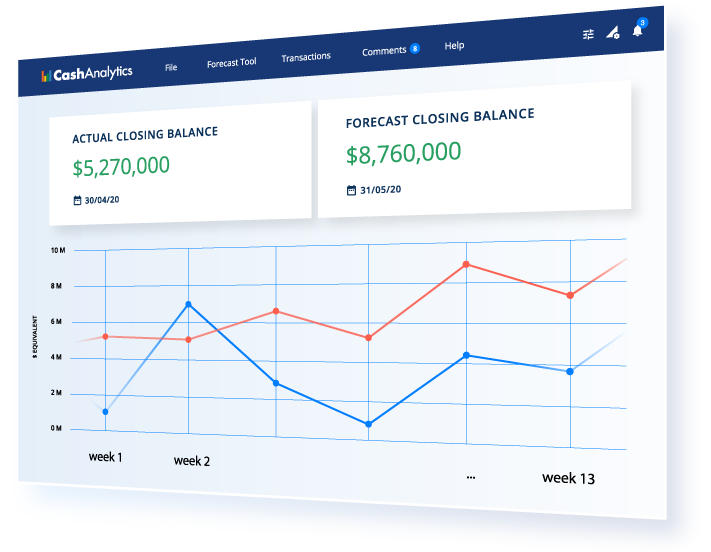

Quickly and easily set-up a 13 week cash flow forecasting model in CashAnalytics that provides clear visibility over short and mid term cash flow.

Automate manual forecasting tasks and the collection of all actual and forecast data to significantly reduce the effort involved in managing a 13 week cash flow forecast.

The 13 week forecast will become an indispensable part of your liquidity management activities ranging from short term working capital management through to covenant reporting.

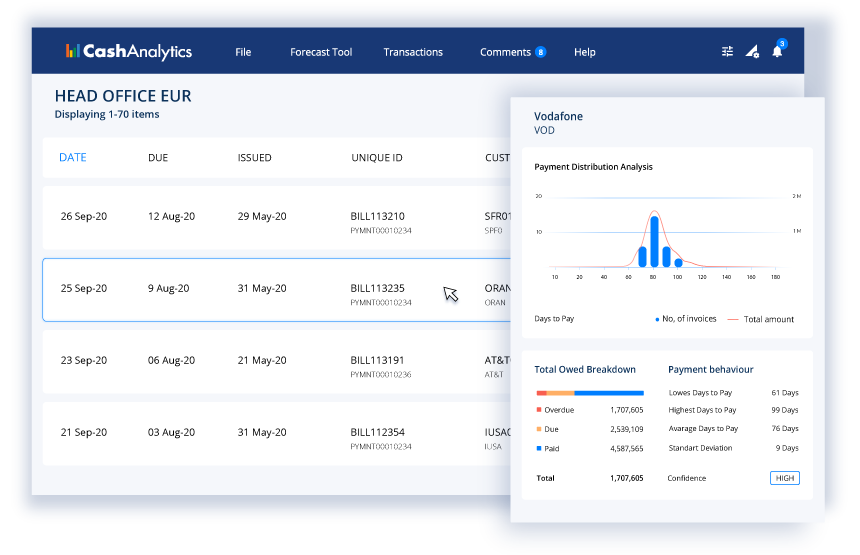

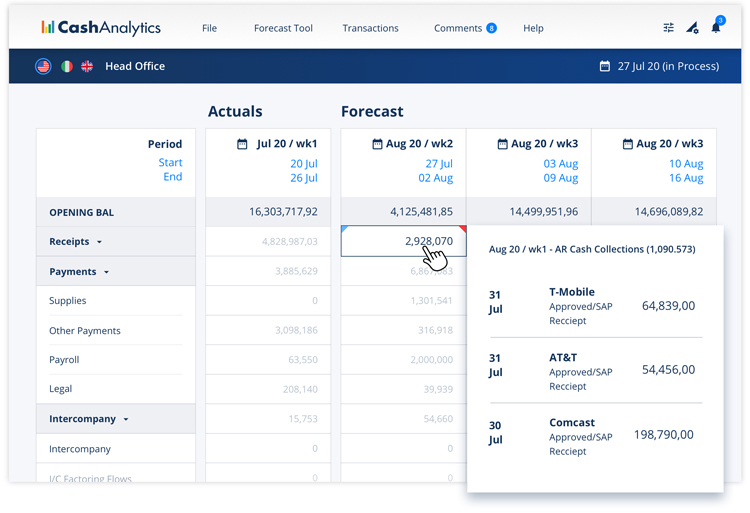

Accounts receivable and customer collection forecasting is the most critical yet often the most challenging part of cash flow forecasting.

CashAnalytics automates the process of forecasting accounts receivable cash collections by connecting directly to ERP systems to capture ledger data and using artificial intelligence to analyze historical payment patterns.

This in turn removes the majority of manual work involved in accounts receivable forecasting while providing detailed insight into customer payment behavior and expected cash collections.

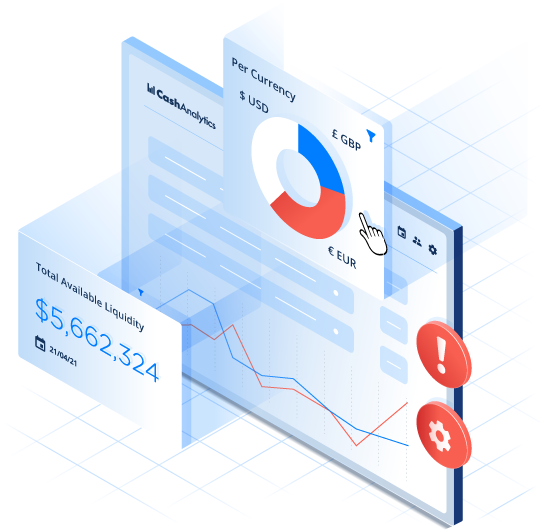

The most important factor in effective liquidity management is having clear visibility over current and future cash flow.

This provides the basis for understanding both what liquidity is available within a business today while also allowing future liquidity shortfalls and surpluses to be quickly identified.

CashAnalytics provides this visibility as a baseline and gives treasury and finance teams a range of automation and analysis tools to further streamline the process of liquidity management and business unit funding.

CashAnalytics automates the process of collecting, consolidating and classifying bank account data on a daily basis.

With data flowing in directly from banks, CashAnalytics then provides a single source of all actual cash balance and transaction information, providing clear visibility over current cash positions and recent cash flows.

Intelligent mapping rules automate the classification and categorization of cash flow data every day, ensuring the data is instantly useful for both reporting and forecasting.

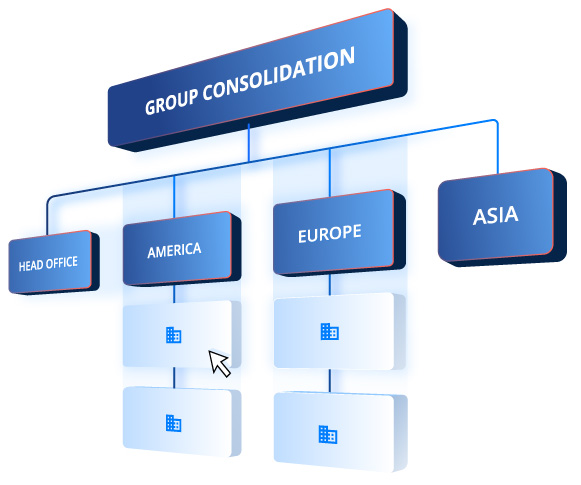

Cash forecasting in businesses with multiple business and locations is difficult due to the effort in collecting and consolidating large amounts of cash flow data in excel templates on an ongoing basis.

Using CashAnalytics, each business unit controller enters or loads their forecast data directly in the system through an intuitive web based interface. This means that all data automatically flows through to a central reporting model, removing the need to collect and manage data manually.

The cash forecast data from all business units can then be quickly and easily consolidated into a single reporting output using a range of reporting tools.

CashAnalytics provides clear and detailed visibility over short term payables and receivables and all other drivers of cash flow through central forecast models and reports.

With access to all cash flow and ledger data in one place, future cash and working capital requirements can be planned with relative ease.

This means that working capital can be optimized to the greatest extent possible and cash flow will always be put to the best possible use.

The simple setup, logic that is easy to understand for everybody in the process, and very flexible customization of the model are the main reasons why we like CashAnalytics so much.

With CashAnalytics you can just log in and see straight away the status of each country without needing to look at spreadsheets.

CashAnalytics is very customer focused and transformative. You get far more value than what you’re paying for. It is the perfect tool for companies of our size and complexity.

CashAnalytics has proven to be a solid solution for our cash forecast management needs, with quick support from a knowledgeable team.

CashAnalytics provides a flexible, easy to handle cash forecasting solution that supports me and my colleagues reliably in our daily work.

I’d describe Cash Analytics as intuitive. The team is very knowledgeable and personable, there is a real willingness to help!

CashAnalytics gives us a real-time cash management system that is accurate each day.

The amazing thing to come out of this harmonised process is the other processes that we can now support in Treasury. We can provide additional insight on payment management and intercompany management, and we have this information at the tip of our fingers … who is paying what to whom and where do the deviations lie.

The biggest challenge that we wanted to address was the time spent on tedious tasks. We wanted to find a tool that makes the entire process a lot easier. If you want to have a happy team, reliable data and to ensure that it’s coming through timelessly as well, then I’d definitely recommend CashAnalytics.

When I first saw the dashboard I got really excited. The key piece of information it shows, for us, is the total bank cash position. Then the ability to separate by entity is really useful for senior management because it allows us to see who is holding too much cash in the business and where we need to look at centralizing cash.