“With any growing company such as RUBIX, it is important to identify cash levels and cash needs across the group quickly, and CashAnalytics allows us to have this view.”

“With any growing company such as RUBIX, it is important to identify cash levels and cash needs across the group quickly, and CashAnalytics allows us to have this view.”

Paul Brighton

Head of Treasury

After being acquired by new private equity owners (Advent International) in 2017, two large European brands (Brammer and IPH) merged to become RUBIX. Consequently, this led to an increased focus on cash flow and a need for reliable visibility over current and future liquidity. After initial requirements were identified, and a competitive selection process with two other vendors, RUBIX selected CashAnalytics as its cash reporting and liquidity forecasting software solution provider.

The Challenge

After the merger, Rubix set up their new head office in London. With a wide range of responsibilities, a cornerstone requirement of the new process was that it would automate as much as possible and run highly efficiently, enabling the team to keep to tight reporting deadlines and maintain a keen focus on cash.

“With any growing company such as RUBIX, it is important to identify cash levels and cash needs across the group quickly” said Paul Brighton, Head of Treasury at RUBIX.

Additionally, as RUBIX operates in a range of countries with a variety of different currencies, it was important that, as part of their cash management activities, head office could perform detailed FX exposure analysis quickly and easily.

Since its recent formation, RUBIX has been through a period of profound growth. Therefore, a solution capable of scaling to support RUBIX’s cash management activities, as to mirror their growth was also paramount.

Key Requirements Overview:

-

Implement a solid 13-week forecasting process to provide rolling visibility over group-wide cash flow and funding needs

-

Gain group-wide bank account visibility, showing total liquidity position covering 350 bank accounts across over 30 banks

-

Output supports critical activities and therefore needs to be of high quality

-

Need to quickly produce reports and forecasts on an ongoing basis

-

Include all forecast contributors (50+ people) without increasing workload

The Solution

After an eight-week project which covered scoping and planning, set-up and training, CashAnalytics was rolled out at Rubix. This was further delivered with quickfire 30-minute web-based training sessions of users across different geographies, who were each provided with customised training and support.

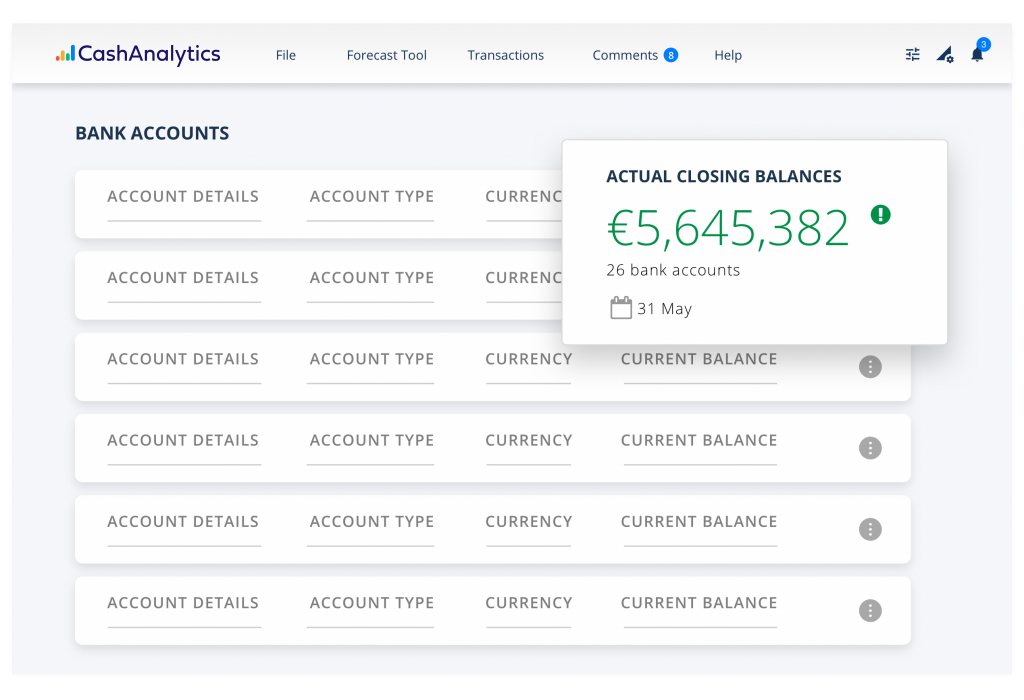

Group-Wide Cash Visibility

Over 350 bank accounts across 30 banks were connected into the CashAnalytics dashboard, offering daily consolidated cash balances and other cash management KPIs.

Quick and Easy FX Exposure Analysis

As mapped out in the requirements at the outset, it was key that the head office be able to perform detailed FX exposure analysis quickly and easily. “The system is regularly used to report currency exposures and provides us with good FX detail for our entities,” Paul confirmed.

Clear Benefits for Day-to-Day Activities

With different teams in business units in various locations, it is important that the head office has a clear understanding of how cash is trending across the group. “On a day-to-day basis, the system is used for Bank Reconciliation, Net Cash Flow Actual Trends and 13-Week Forecast Reporting,” noted Paul, “the view that we gain through CashAnalytics allows us to challenge our teams’ numbers across the Group.”

“CashAnalytics is of great importance to our company. It’s an effective yet simple solution that’s easy to use, with high quality support from the CashAnalytics team.”

– Paul Brighton, HEAD OF TREASURY

Carefully Managed Roll-Out

With over 50 people across the business, involved in the project process, our Customer Success team were committed to minimising any disruption to day-to-day operations while, quickly delivering value to all stakeholders. “CashAnalytics is of great importance to our company. It’s an effective yet simple solution that’s easy to use, with high quality support from the CashAnalytics team,” adds Paul.