“I’d describe Cash Analytics as intuitive. The team is very knowledgeable and personable, there is a real willingness to help!”

“I’d describe Cash Analytics as intuitive. The team is very knowledgeable and personable, there is a real willingness to help!”

Andy Hawes

Group Treasurer

Having joined Innospec in 2018 Andy Hawes, Group Treasurer, faced the challenge of introducing a group wide cash forecasting process. The Treasury team at Innospec are responsible for cash forecasting and liquidity planning, including operations in twenty-four countries. Shortly after the implementation of an Excel based cash forecasting process, Innospec recognized the need for better data resilience across their business. This lead to the search for a cloud-based cash forecasting solution.

The Challenge

Before using the CashAnalytics system, Andy initially set up a forecasting process in Excel, which was rolled out globally at Innospec. Previously, each Finance team across the various entities prepared their cash forecasting manually in Excel. This was later sent to the Group Treasury team for consolidation. However, managing huge amounts of data in spreadsheets, which builds up very quickly, became arduous.

The Excel spreadsheets that Innospec operated previously, did not allow for complexities like intercompany transactions. “We were using an Excel based system, but it took quite a bit of work to get to a forecast and it didn’t do the complexities like intercompany transactions well”, said Andy Hawes, Group Treasurer. Bank account visibility across the group was hard to navigate, resulting in a lack of visibility of cash.

Andy recognized that Innospec required a solution that would eliminate the difficulty associated with manual reporting, save time, and improve visibility. Increasing security requirements across the business meant that an already administrative process ballooned to the point that accurate global consolidation reporting became hugely challenging.

“What was a fairly intense job became a very intense job as the complexity grew and of course the timeliness and accuracy was affected. You need to produce your cash forecast in the first week of the month”, said Andy.

Having previously used CashAnalytics in a former role, Andy was confident our solution would help his team save time and gain clear visibility over current and future cash, and liquidity across the business.

Key Requirements Overview:

-

Delivery of a robust, timely and accurate cash flow forecasting process

-

Accurate Intercompany cash flow management

-

Data integrations with bank reporting and automated classification

-

Touch of a button reporting including in depth accuracy analysis

The Solution

Cash Insights That Move The Needle

“CashAnalytics helps us manage risks”, said Andy. By automating the cash forecasting process across the group Andy and his team have identified insights that allow him to react and add real value.

“I’d describe CashAnalytics as intuitive. The team is very knowledgeable and personable, there is a real willingness to help!”

– Andy Hawes, Group Treasurer

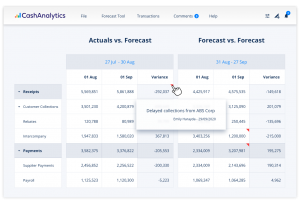

Accuracy and variance analysis are often the missing pieces from cash forecasting processes. CashAnalytics has created a strong feedback loop between the Treasury team and its subsidiaries. The Treasury team can detect and drill down to the underlying causes of variances and easily interrogate the accuracy, something that Andy has now embedded into their process. “Before CashAnalytics I was spending a lot of time trying to find the variance or what they were, now when I’ve got a variance, I know where it is. I can see it”, added Andy.

Andy also uses CashAnalytics as a FX risk management tool, a difficult area to manage without in-depth visibility. He can now conduct detailed analysis of how Foreign Exchange exposures arise in the business and manage these risks.

“Before CashAnalytics I was having to spend a lot of time trying to find the variants or what they were, now when I’ve got a variance, I know where it is. I can see it.”

– Andy Hawes, Group Treasurer

Automated Bank Reporting

CashAnalytics automates the process of collecting, consolidating, and classifying bank account data daily.

Before using CashAnalytics the process was slow, carried out manually with spreadsheets circulated by the various entities, and the need to log into multiple bank portals. By connecting their banks directly to CashAnalytics, Andy and his team now have an immediate and real time view of all bank balances and transactions. Intelligent mapping rules automate the classification and categorization of cash flow data every day, ensuring the data is instantly useful for both reporting and forecasting.

100% Group Wide Reporting

CashAnalytics has an Excel like interface that is very easy to use. This has been a big advantage to Andy rolling it out across the group. Mirroring their exact reporting requirements and line-item templates, it was immediately familiar for new users, resulting in fast user adoption. “The interface is very similar to how we forecasted in Excel. When our unit users started using the system, they already knew what they were doing”, added Andy.

Large amounts of data across the business are now easily consolidated into one simplified output, reducing the time spent on cash flow forecasting by days and increasing accuracy.

Andy also informs us how useful he finds the comparison tool, an additional piece of analysis now ingrained into their process, whereby he can analyze forecast vs forecast and forecast vs actual, to understand trends and change expectations across the forecast model.

As a direct result Innospec has gained a clear view of business performance. “Implementing the system allows us to have visibility across the business and the CFO trusts the forecasts”, states Andy.